💼 Amazon Builds

briefcase | invest smarter

What will be the top performing real estate asset of 2024?

Salary, Benefits, Apartment

Story: Amazon is stepping up its game in the affordable housing arena, injecting a hefty $16 million loan into a South Seattle residential project. This project, spearheaded by Housing Diversity Corporation, is set to kickstart construction of the Atrium Court, a 271-unit complex sprawling over 148,000 square feet with a touch of retail magic on the ground floor. This move isn't just a one-off; it's part of Amazon's grand plan, with around $550 million already funneled into housing projects in the Seattle area.

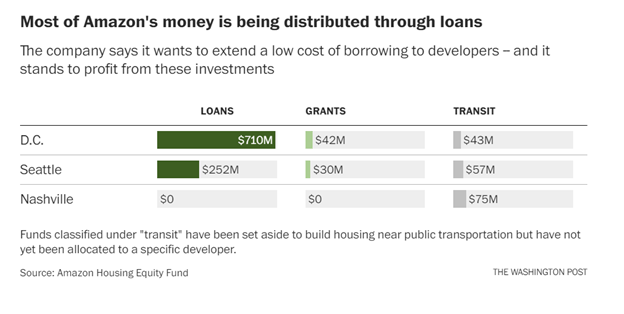

And it’s not just Seattle, Amazon is giving out loans like it’s Prime Day to encourage more development in key headquarter locations.

Big Picture: Amazon's foray into affordable housing echoes a broader trend among employers, especially in high-cost areas.

Teachers, police, nurses, and even theme park employers are all rushing to do what others can’t or won’t do: Build housing.

According to NCTQ, starting teacher salaries in 15 of 69 US cities cannot cover a one-bedroom rental. Further, although home prices have risen 40% since 2017, starting teacher salaries have only increased 15%.

NCTQ found that teachers need three times longer than the average US household to save for a 20% down payment. No wonder there are over 36,500 teacher vacancies in the US, according to Professor Tuan Nguyen from Kansas State University.

So what are school districts doing? Trying to add more supply by partnering with builders. Now, that’s a lesson for you!

In partnership with a nonprofit, a teacher complex was built earlier this year in Los Gatos, California.

San Francisco's school district built a teacher housing project with a nonprofit developer. They’re considering another.

Austin’s school district seeks to build and manage teacher housing complexes on underutilized district land.

A school superintendent in Arkansas proposed developing 9 acres of district land for housing, according to Axios.

According to media reports, Pojoaque Valley School District in New Mexico secured federal funding to build modular homes for teachers.

High housing costs increasingly clash with salaries, forcing critical workers like teachers, healthcare professionals, and even law enforcement to live miles away from their jobs. This situation nudges employers like Amazon to step in, not just as corporate giants but as community stakeholders, addressing housing challenges to attract and retain a stable workforce.

So What: Amazon's move is a clarion call. Remember Pella, Ohio? There's a burgeoning market segment yearning for affordable housing solutions. This trend presents an opportunity for innovative development projects, partnerships with corporations, and investments in housing models that cater to this growing workforce housing need. It's a chance to blend profitability with social impact, creating housing that's not just a commodity, but a community cornerstone.

HEADLINES

Blackstone Acquires: Blackstone Inc. invests in rental housing with a $3.5 billion deal to buy Tricon Residential Inc., a Toronto-based landlord. This deal will add Tricon's 38,000 US rental houses, apartment buildings in Toronto, and land slated for development to Blackstone's portfolio. The deal is being financed by Blackstone's $30 billion Real Estate Partners X fund and the Blackstone Real Estate Income Trust. Blackstone plans to complete $3.5 billion of projects already in Tricon’s pipeline and an additional $1 billion in capital projects over the next few years. The deal is expected to close in the second quarter. Tricon's Canadian real estate portfolio is estimated to bring in $50 million net operating income in 2028. (BI)

Far-Right Real Estate: A venture fund, New Founding, and a real estate startup, Kentucky Ridge Runner LLC, both linked to far-right organizations, are promoting a residential development in rural Kentucky as a haven for like-minded individuals. The "Highland Rim Project" is part of a trend among the far-right to establish geographical enclaves. The development, announced on social media platform X, offers various-sized lots at different price points, including 17 lots of about 3.5 acres each on a 550-acre farm for about $40,000 each, and four other lots of between 90 and 125 acres priced around $400,000 each. Critics argue that the project may be more of a money-driven land speculation project than a genuine attempt to create a utopian community, raising concerns about potential discrimination in land sales based on political views. (TRD)

Deflation Station: China's economy is facing a potential deflation crisis, with analysts predicting a "very painful economy" for the next three to six months. Shaun Rein, founder of the China Market Research Group, has expressed concern over the country's economic situation, stating that it is the worst he has seen in his 27 years there. The People's Bank of China has maintained its one-year and five-year loan prime rates at 3.45% and 4.2%, respectively, despite expectations of more sluggish economic growth in 2024. The Chinese government has set a growth target of 5% for 2024; however, the International Monetary Fund predicts a slowdown to 4.6%. Moody's predicts China's real GDP growth will hit 4% in 2025, down from an average of 6% between 2014 and 2023. The country's real estate market, which accounts for about a third of China's economic activity, is also experiencing a downturn. (CNBC)

BY THE NUMBERS

⤴️ 50%: In 2024, the U.S. apartment supply will reach approximately 670,000 units, a 50% increase from the record 440,000 units in 2023. This could impact the health of multifamily markets across the nation. Stable Midwest markets like Chicago, Cincinnati, Cleveland, and Columbus, along with Northeast metros Boston and New York, are expected to outperform in 2024, with occupancy rates above 94% and rent growth below 4%. Other markets with potential upside include Houston, San Diego, San Jose, and Washington, DC. However, markets like Las Vegas, Los Angeles, Portland, San Francisco, and Oakland could face demand challenges. Austin, Charlotte, Dallas/Fort Worth, Nashville, Orlando, Phoenix, and Salt Lake City may see solid demand, but intense supply could limit rent growth. (RealPage)

⤴️ 29%: The Mortgage Bankers Association (MBA) predicts a 29% increase in total commercial and multifamily mortgage borrowing and lending, reaching $576 billion in 2024, up from an estimated $444 billion in 2023. Multifamily lending alone is expected to rise by 25% to $339 billion this year. In 2025, total commercial real estate lending is projected to increase to $717 billion, with $404 billion in multifamily lending. However, 2023 is expected to be the slowest year for commercial real estate borrowing and lending in about a decade. (MBA)

🫢 5.6x: In 2022, the US's median sale price for a single-family home was 5.6x higher than the median household income, a record high since the 1970s. This is a significant increase from 2019, when the national price-to-income ratio was 4.1. Among the 100 largest markets in the country, 48 had a price-to-income ratio exceeding 5.0 in 2022, including seven markets with a ratio above 8.0. In comparison, only 15 markets had ratios above 5.0 in 2019 and just five in 2000. The highest price-to-income ratios in 2022 were in Honolulu (12.1), San Jose (12.0), and San Francisco (11.3). Nationally, home prices grew by 43% between 2019 and 2022, while incomes grew by just 7%. (Harvard)

Disney and Universal Cast Spells on Housing Market

Mickey’s New Mansion: Florida's major theme parks, Universal Studios Florida and Walt Disney World, are addressing their employees' housing struggles. NBCUniversal and The Walt Disney Company plan to construct employee housing developments. Universal Studios is planning a 1,000-unit mixed-use development on 20 acres of land donated by the company, set to open in 2026. Disney announced it would donate 80 acres for a proposed 1,450-unit affordable development set to open in 2026. Disney plans to double capital expenditures to roughly $60 billion over ten years. The Central Florida region has seen a $600 increase in monthly rent between early 2020 and early 2023, and the Orlando-Kissimmee-Sanford metro area has a severe affordable housing shortage, with only 15 available units for every 100 extremely low-income renter households. (HW)

🪄🪄 At least this housing story has a happy ending.