💼 Zero Interest Rate Policy (ZIRP)

briefcase | invest smarter | Issue #113

⚡ ZIRP

ZIRP. It sounds like the name of a world-eating intergalactic leviathan that has awoken from a 200-million-year slumber.

But the truth is much more boring.

Zero interest rate policy (ZIRP) has been the de facto policy for global central banks over the past decade, whereby interest rates are kept near 0%. The goal of ZIRP is to encourage economic activity with low-cost borrowing and easy access to cheap credit.

🪦 Thankfully, today, we are gathered to mourn the death of one of our closest friends, ZIRP 🙏🙏🏻🙏🏾.

Aside from being a pure joy to say out loud...ZIRP...This dear friend gave us an era of free money and excess unprecedented in our lifetimes. But it's time to say...

ZIRP was necessary for a short period of time in 2008, and literally saved us from a cataclysmic economic disaster. But it stuck around, long after it was needed. Like that awkward friend who just doesn't know when to leave.

And, ZIRP ultimately led to not only excess spending but unhealthy and unrealistic business valuations.

This era is over, and we are now entering a period of austerity. And guess what? This is a good thing.

Some of the best businesses and leaders are forged during times of austerity and depression. For instance, GE (Panic of 1893), GM (Panic of 1907), Disney (1929, Great Depression), HP (Stock market crash of 1939), Microsoft (Recession in 1975), Google (Dot-com bubble 1998), or Airbnb, Uber, and Slack (2008-2009).

The reality is that in times of economic friction, founders and leaders are forced to focus on building cash flow over getting complacent with free-flowing investment and capital.

ZIRP & Real Estate

The Federal Open Market Committee (FOMC) two weeks ago raised the federal funds rate by 25 basis points to the 4.50%-4.75% range. This follows four 75 basis point increases, starting last November, and a 50 basis point increase in December (total increase to 450 bps since March 2022).

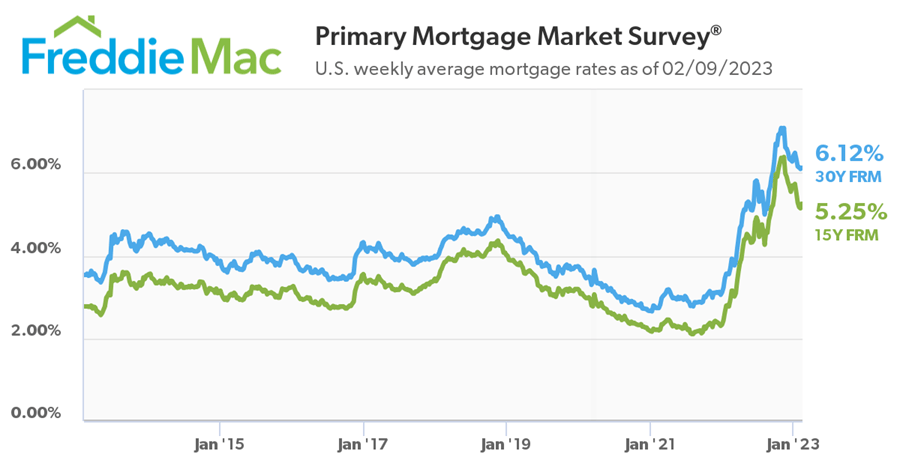

Average mortgage rates now hover around 6% after falling from a high of 7% last fall.

Interest rates a rising in an attempt to control the inflation that was (partly) caused by ZIRP.

We find it funny that the Fed is so angry and seemingly surprised by inflation that was primarily caused by over a decade of ZIRP. It's like a child burning the roof of their mouth on pizza after you warn them several times that it's hot. To be fair though, pizza is the best, and we've all been there.

TLDR: When money was more accessible through the Fed's quantitative easing (QE) policies, demand for goods and services increases, putting upward pressure on the price of everything.

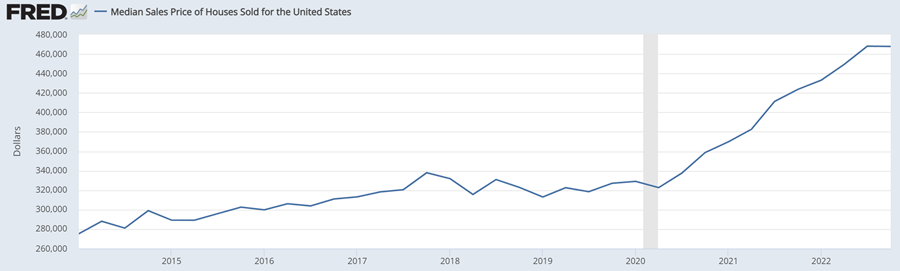

That includes housing. The end result will be demand will decrease for real estate assets because the debt needed to finance them is no longer ZIRPed.

It's more expensive. This, in turn, will have a chilling effect on real estate prices, something we are already witnessing.

Prices have flatlined. Look for more of this, or slight declines, in the coming years as we settle into a post-ZIRP world.

So What? All signs point to rising interest rates. Amazing jobs data and inflation in the 6% range when the Fed wants 2% means that smart money is saying the Fed will either hold rates steady or increase them from here.

That is, until we hit more turbulent economic headwinds.

For now, the highlight is that ZIRP is dead, and we should be happy about that.

Weekly Real Estate News

👏 Zoning Reform: Zillow’s panel of experts call to fix zoning to improve housing affordability — Zillow

🛑 HOOOOLD: In a braveheart move, the Bank of Canada paused interest rate increases on Wednesday — WSJ

📈 Equity: Homeowner equity increased 7% YoY in Q4 2022, with the highest ($49K) seen in Florida — CoreLogic

📉 Supply Snag: Still isn't keeping up with demand, with householder formation outpacing new housing supply — Realtor.com

🏢 Flat Rent: One and two-bedroom rentals remained unchanged in January at $1,492 and $1,824, respectively — Zumper

😨 California Nightmaring: According to data, California is the most vulnerable to ongoing housing price declines — ATTOM

👨💼 (Less) Office Space: Commercial real estate has a shock coming as return-to-office plans fall short — CNBC