👋👋 Good morning real estate watchers! Today, we are going to talk about...

Americans are finally realizing that maybe we don’t need 3,000 square feet just to avoid seeing our kids. A smaller house means you have to talk to them—so, you know, pros and cons.

Corporate relocation are rising—because nothing says "employee quality of life" like moving headquarters to a state where the only local attraction is a 24-hour Waffle House. (Though honestly, that’s a strong selling point.)

Brian Chesky boldly declares that physical experiences and community trump AI, proving that no amount of technology can replace the thrill of awkwardly sharing a bathroom with strangers on vacation.

Let’s go!

TOP STORY

SMALLER IS BETTER

For decades, America’s housing mantra has been “bigger is better.” Suburbs sprawl with McMansions boasting cavernous great rooms, multiple guest bedrooms, and garages large enough to house small fleets. Big houses are like cargo shorts: sure, they’re practical, but do you really need that many pockets? At some point, you’re just hoarding space for no reason

But a growing countertrend suggests that smaller might just be the new status symbol—fueled by affordability concerns, changing lifestyles, and a reevaluation of what "home" really means.

The Big House Boom—And Its Decline

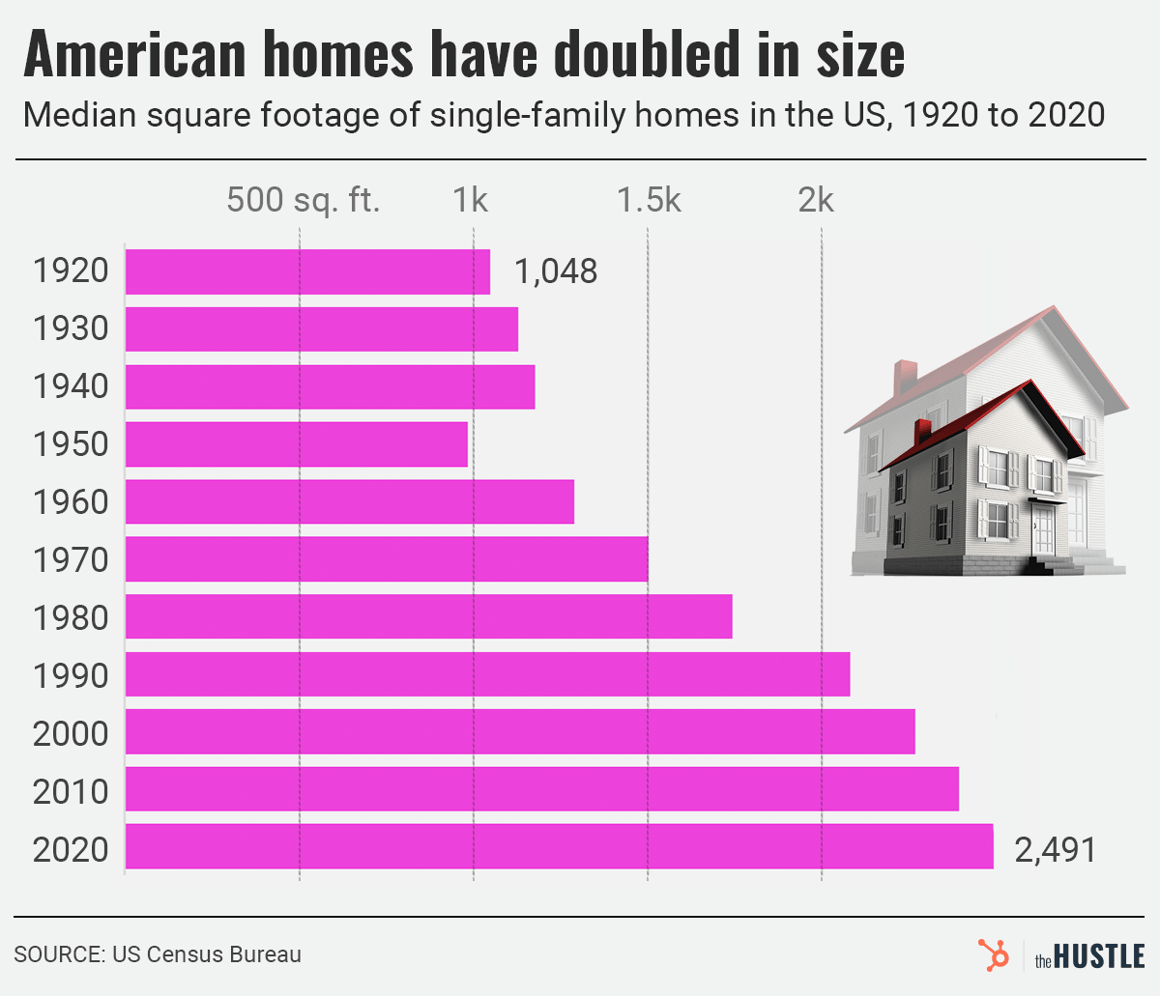

Over the past century, the median size of new single-family homes ballooned from just over 1,000 square feet in 1920 to nearly 2,500 square feet by 2020, according to U.S. Census data.

Meanwhile, household sizes have shrunk from an average of 4.3 people to 2.5 today. The result? A glut of empty bedrooms—31.9 million to be exact—marking an all-time high.

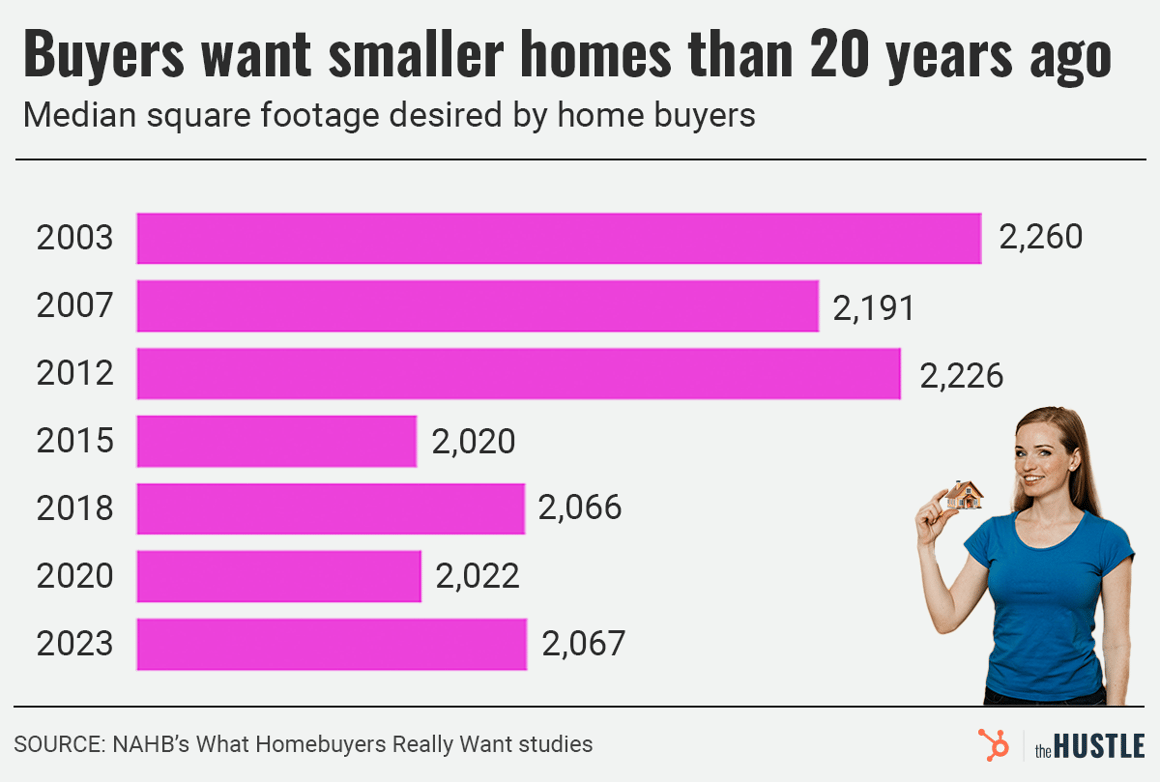

But the tide may be turning. The National Association of Home Builders (NAHB) reports that the average desired home size in 2024 is down 10% from a decade ago, hitting a 15-year low. Builders respond accordingly: nearly four in 10 report constructing smaller homes to meet shifting buyer preferences.

As a result, the number of “extra bedrooms”—rooms in excess of household members—has reached a record 31.9 million, according to a report from Realtor.com. "We are seeing more guest rooms for two main reasons: homes getting bigger and household size getting smaller," says Ralph McLaughlin, senior economist at Realtor.com.

The so-called “McMansion” boom of the 1980s and 1990s epitomized the bigger-is-better mentality, but the trend has cooled. Since peaking at 2,800 square feet in 2015, the average size of new homes has declined yearly, reaching 2,300 square feet in 2023—a 15-year low.

Why Smaller Homes Make Sense

Affordability is a key factor driving this change. "Buyers are reacting to a low-inventory, low-housing-affordability environment," explains Robert Dietz, chief economist at the National Association of Home Builders (NAHB).

And the appeal of smaller homes goes beyond just the price tag. Rising energy costs and environmental concerns are prompting many buyers to opt for more efficient spaces. Additionally, the pandemic-era shift to remote work has altered how people use their homes, making functionality more important than size.

Builders Adapt to Changing Tastes

Recognizing this shift, builders are adjusting their strategies. Nearly four in 10 homebuilders report constructing smaller homes to meet buyer preferences, according to NAHB surveys. While building larger homes often offers better profit margins for developers—thanks to the economies of scale involved in fixed costs like land and utilities—many are scaling back to align with market demand.

McLaughlin also highlights how regional differences impact this trend: "Spare rooms are more popular in cheaper areas where it’s more affordable to buy a home with extra bedrooms."

Downsizing: A New Kind of Dream Home

Smaller homes are redefining the American Dream. Buyers increasingly prioritize affordability, energy efficiency, and practicality over square footage. "If people value having extra space, then we didn’t overbuild during the McMansion era," McLaughlin muses. "But if homebuyers are simply tolerating these big homes because they’re what’s available, then perhaps we did overbuild a bit over the past few decades."

This rethinking of space doesn’t just make financial sense—it aligns with the evolving values of today’s homebuyers. After all, who needs a 4,000-square-foot house when your family comfortably fits into 1,800? Sometimes, less really is more.

SNIPPETS

1️⃣ Footloose and Fancy Headquarters: Corporate relocations are poised for a surge in 2025, with many companies considering moves to reduce costs and improve the quality of life for employees. Factors driving these decisions include lower tax rates, affordable housing, and access to talent. While attracting headquarters can boost a city's economy and reputation, offering excessive incentives may not always yield the promised benefits. The trend is shifting towards smaller, more flexible office spaces as firms adapt to hybrid work models. Cities like St. Petersburg, Florida, are actively courting relocations, hoping to spur economic growth and development. (Bloomberg)

2️⃣ CRE's Optimistic Tightrope: The commercial real estate (CRE) market shows signs of optimism as the Fear and Greed Index reaches 56, indicating expansion. Investors are particularly bullish on multifamily and industrial sectors, with 50% planning to increase CRE exposure in the next six months. Despite recent Federal Reserve rate cuts lowering borrowing costs, 31% of CRE loans maturing in 2025 face higher refinancing costs, especially in the office and multifamily sectors. The looming maturity wall and potential valuation drops present challenges but also create opportunities for distressed asset investments. (CRE Daily)

3️⃣Airbnb's AI-rborne Ambitions: Airbnb CEO Brian Chesky has hinted at significant changes coming to the company in 2025, with a focus on reimagining its Experiences section. Despite the current AI revolution, Chesky believes that physical experiences and community still trump digital ones and that AI has yet to substantially change most people's lives. He predicts that AI will eventually transform the physical world, but it will take time. Chesky also discussed his leadership style, revealing that he closely monitors numerous projects and prioritizes group meetings over one-on-one sessions to engage with staff at multiple levels. (Wired)

4️⃣ Housing's Lock-In Limbo: Fannie Mae's Economic and Strategic Research Group forecasts that housing activity will remain subdued in 2025 due to affordability issues and the "lock-in effect." Despite expectations of a solid broader economy, the housing market faces challenges with mortgage rates predicted to stay above 6%, existing home sales near 30-year lows, and decelerating national home price growth. The report highlights regional differences in market conditions, with the Sun Belt expected to see stronger activity compared to supply-constrained areas like the Northeast. (Fannie Mae)

5️⃣ Miami's Sinking Skyline: A University of Miami study has revealed that 35 luxury beachfront buildings in Miami-Dade County, including condos and hotels in Surfside, Bal Harbour, Miami Beach, and Sunny Isles, have been sinking at unexpected rates between 2016 and 2023. The affected structures, which house thousands of residents and tourists, have subsided by up to three inches. Experts suggest this could be linked to rising sea levels and limestone erosion caused by climate change. While the implications are unclear, the findings raise concerns about long-term structural integrity and highlight the need for further investigation and monitoring of coastal development on vulnerable barrier islands. (Miami Herald)

6️⃣ Home Alone: Single-Family Edition: In our new favorite holiday film, U.S. housing starts unexpectedly fell 1.8% in November to a four-month low of 1.29 million annualized units, primarily due to a sharp 23% drop in multifamily construction. Single-family home starts, however, increased by 6.4%, driven by an 18.3% surge in the South as the region rebounded from hurricane-related delays. Despite this localized boost, overall housing demand remains constrained by high mortgage rates, with the outlook for the construction industry becoming increasingly uncertain. (Yahoo!)