👋👋 Good morning real estate watchers! Today, we are going to talk about...

Real estate investing platform Landa’s app froze just as dividends disappeared. That’s not a ‘server outage,’ that’s the financial equivalent of texting ‘new phone, who dis?’ to 25,000 investors at once.

Marvel at builders who now hit Ctrl-P on entire houses, proving the only thing faster than 3-D printing is the panic attack you get when you see the shipping costs.

Obsolete office towers reboot their careers as luxury apartments, reminding us that while workers won’t return to cubicles, cubicles might just return as studio lofts.

Let’s go!

TOP STORY

FRACTIONAL FIASCO

Dane Moreton still remembers the push notification that sold him on the idea of becoming a landlord for the cost of a latte: “Own real estate for $5!” the Landa app beamed in August 2023. But, as it turns out, Landa went down faster than the Titanic’s Wi-Fi.

As we will see, maybe investing in real estate isn’t the same as buying a latte.

Within weeks, Moreton put $7,000 into 13 pastel-painted rentals on Atlanta’s fringes. Dividends flickered out months later, the app froze, and, by February, a New York judge had yanked 119 of Landa’s houses into receivership after the startup allegedly siphoned tenant rents to a secret bank account. “If Mr. Cohen really flouted those orders, he needs to be hunted down and made to pay,” Moreton says, sounding less like a passive investor than a bounty hunter.

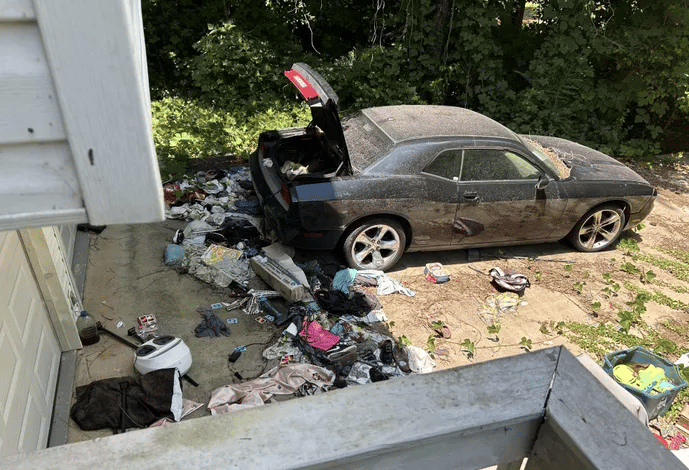

Bisnow - One of the properties subject to the court order in Douglasville, Georgia, photographed last summer.

Blitz-scale, then belly-flop

Founded in 2019 by Israeli entrepreneurs Yishai Cohen and Amit Assaraf, Landa emerged from stealth in August 2022 with $33 million in venture funding from NFX, 83North, and Viola Ventures and a pitch to “democratize” rental income. Users over 18 could buy fractional shares of single-family houses—some for the price of a Subway foot-long—and track real-time performance on a slick mobile dashboard.

Landa layered on roughly $60 million in short-term loans to feed that promise, amassing more than 200 Atlanta-area rentals and a handful of Brooklyn walk-ups in the low-rate frenzy of 2021-22. According to investor presentations reviewed by TechCrunch, the company boasted 25,000 investors and about 400 properties at its peak.

Then the Federal Reserve turned off the cheap-money faucet. Rising mortgage costs crushed the thin spread between Landa’s rents and debt service, vacancies climbed, and liens piled up. An SEC filing shows its largest fund lost $1.8 million in the first half of 2024, quadruple the prior-year deficit.

A $35 million courtroom brawl

By November 2024, primary lenders Viola Credit and L Finance sued in the New York Supreme Court, accusing Landa of “numerous defaults” on $35 million in loans, unpaid property taxes that forced fire sales, and—most damning—of ignoring an injunction to surrender rent rolls.

“Defendants brazenly have acted as if no restraints whatsoever have been imposed upon them,” the lenders told the court after discovering $724,000 missing from frozen accounts. Judge Jennifer Schecter threatened contempt and installed restructuring veteran Anna Phillips (fresh off the CrowdStreet scandal) to run the portfolio.

Landa lawyer Lee Bergstein countered that the startup “disputes the allegations” and expects the process “to bear out their version of events.” Cohen himself isn’t a defendant but has agreed to a deposition.

While lawyers sparred, ordinary users found withdrawals disabled and dividends AWOL. One early adopter told TechCrunch he emailed support for months and got “deflecting answers, nothing real… then the app became unusable.” More than 130 complaints now clog the Better Business Bureau.

Asked in April whether Landa was dead, Cohen replied, “Of course not. The site will be back up… It’s unrelated to dividends. It’s from our servers. We are on it.” The website still flashes a maintenance banner.

Three hard lessons

Leverage cuts both ways. Cheap debt amplifies returns—until rates rise. Landa’s high-octane borrowing turned a $60 million booster rocket into a debt trap.

Liquidity promises aren’t guarantees. The app’s “trade shares anytime” feature vanished when cash tightened, leaving investors with digital IOUs.

Governance beats gimmicks. Retail shareholders discovered they rank below banks, liens, and a judge’s patience without independent custodians or audited reporting.

As Moreton waits for his $7,000 to resurface, he’s sworn off $5 landlord dreams. “Democratizing real estate is great,” he says, “just make sure there’s still a democracy when the dividends stop.”

SNIPPETS

1️⃣ Rental Resilience: The apartment sector demonstrated robust performance in Q1, with a net absorption of nearly 147,000 units and national vacancy rates dropping to a two-year low of 5.0% - 50 basis points below the long-term average. Despite growing economic uncertainties around tariffs and policy shifts that might impact consumer sentiment, the multifamily market shows resilience, with vacancy rates compressing in 48 of 50 major metros across all apartment classes. Encouraging factors include recent job creation in renter-heavy sectors, rising wages (up 4.4% year-over-year), and an emerging construction pullback, which should help balance supply and demand. While potential economic headwinds exist, the current fundamentals suggest a stable and potentially opportunistic environment for real estate investors focused on residential rental properties. (Marcus & Millichap)

2️⃣ Prefab Panic: The emerging modular and 3D-printed home construction sector for real estate investors represents a compelling opportunity amid growing climate-related housing challenges. The market is experiencing significant shifts, with alternative construction methods cutting rebuild timelines by up to 50% and reducing costs in disaster-prone regions like California, Florida, and Hawaii. Companies such as ICON and Hapi Homes demonstrate the potential for scalable, efficient housing solutions, with public-private partnerships and increasing legislative support signaling a transformative trend. While challenges remain, including high transport costs and long-standing industry skepticism, the sector shows promise, particularly as natural disasters become more frequent. (CRE Daily)

3️⃣ Office Space Exodus: CBRE reports that U.S. office space conversions and demolitions are set to outpace new construction for the first time since 2000. The key stats are eye-opening - 23.3 million square feet of office space will be demolished or converted by year's end, compared to just 12.7 million square feet of new construction. Manhattan leads the conversion parade with 10.3 million square feet, followed by Washington D.C. and Houston. Apartments are the conversion MVP, accounting for 76% of projects, with 33,000 units already added since 2016 and another 43,500 units in the pipeline. While these conversions won't solve the entire housing shortage, they represent a strategic market adaptation driven by high vacancy rates (currently around 19%), evolving urban landscapes, and the ongoing challenge of obsolete office spaces. (CoStar)

4️⃣ Concrete Capitalism: The Sun Belt, particularly Texas and Florida, is emerging as a hotspot for development. Houston leads the pack with 11,047 permits and 1,314 home sales, while Dallas, San Antonio, and Austin also show strong activity. Interestingly, new construction remains robust despite market cooling in these traditionally hot regions. Florida cities like Tampa and Orlando are bouncing back from hurricane damage, driving permit issuances. The most surprising market is New York, ranking third in building permits with 6,307, with projected zoning changes expected to produce 82,000 new homes over the next 15 years. (HW)

5️⃣ Bank Lending Rollercoaster: By the end of 2024, commercial mortgages stood at a whopping $4.79 trillion, with commercial banks' market share dropping from 39% to 33%, a substantial 17% decline. Federal Reserve data reveals dramatic lending volatility: peaking at $75.5 billion in December 2022, then plummeting to -$4.1 billion by March 2025 before slightly rebounding. Banks are cautiously re-entering the market, strategically bundling troubled loans for sale and seeking new opportunities, while remaining hyper-aware of changing fundamentals in the office and multifamily sectors. (Globe St)