👋👋 Good morning real estate watchers! Today, we are going to talk about...

Lizzie Magie invented Monopoly to warn people about capitalism, and then capitalism did exactly what she warned against—it stole her idea, erased her name, and paid her less than the cost of one Boardwalk hotel.

Former cubicle farms are being repackaged as luxury apartments. So if you've ever dreamed of living where Karen from accounting used to microwave fish at lunchtime, congratulations, your moment has arrived!

People are fleeing high-tax states like they just saw a cockroach in their rent-controlled New York apartment. Meanwhile, Florida, Texas, and Tennessee are rolling out the welcome mat—just make sure you can handle humidity, cowboy boots, and the occasional alligator.

Let’s go!

TOP STORY

MONOPOLY

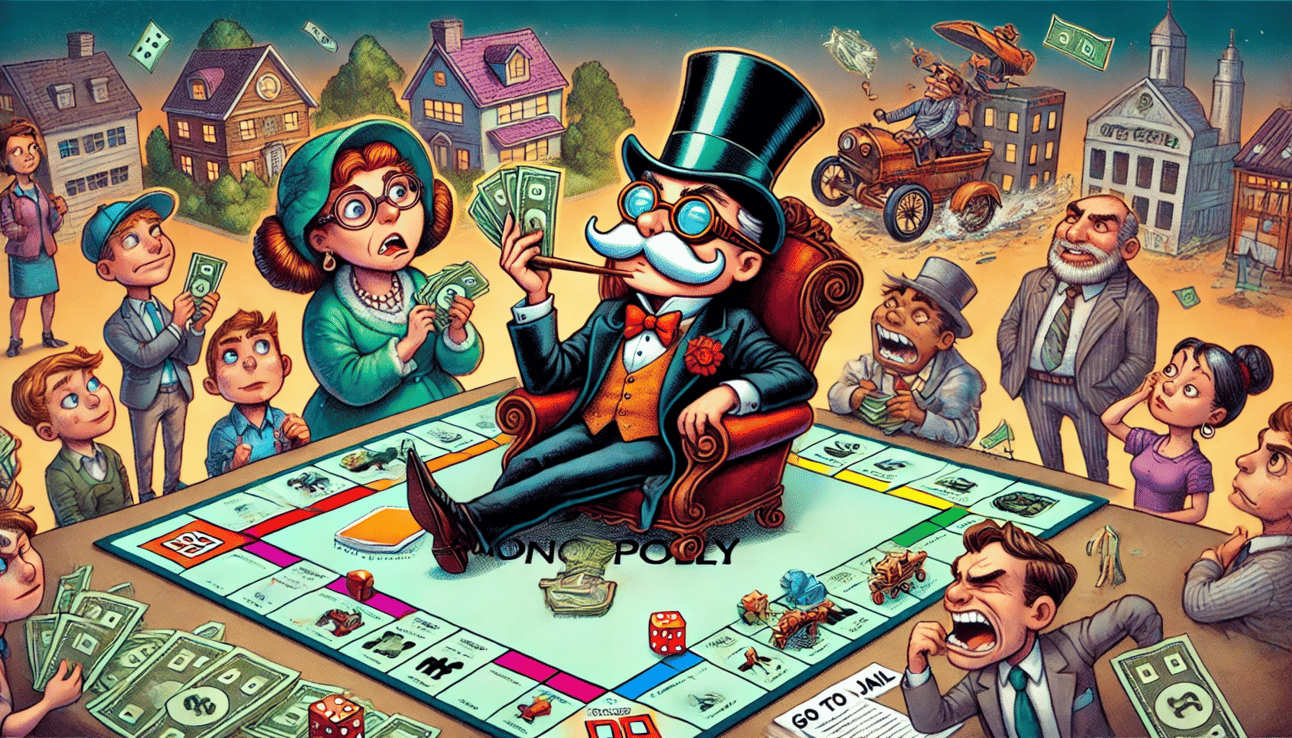

Every family game night has that moment: Someone flips the board, fake money goes flying, and a once-loving sibling is now an enemy real estate mogul. Monopoly, the game that turns Sunday dinners into capitalist battlegrounds, has taught us cutthroat financial lessons for nearly a century.

But what if I told you Monopoly wasn’t designed to glorify monopolists at all? Instead, it was meant to be a cautionary tale about their dangers. The origin story of Monopoly is riddled with irony, deception, and one woman’s lost legacy.

The True Inventor: A Woman Erased

While Charles Darrow, an unemployed salesman in Depression-era Philadelphia, is often credited with creating Monopoly, its real creator was Lizzie Magie, a feminist and progressive thinker who designed The Landlord’s Game in 1903.

In reality, Charles Darrow’s invention of Monopoly is like me ‘inventing’ a Big Mac by walking into a McDonald’s, taking one off someone’s tray, and then selling it back to them for triple the price.

Magie, a devoted follower of economist Henry George, wanted to demonstrate the perils of unchecked capitalism through an interactive game. Her board featured properties, rents, and a tax-based system highlighting wealth inequality.

"Let the children once see clearly the gross injustice of our present land system," Magie wrote, "and when they grow up, the evil will soon be remedied."

But instead of sparking an economic revolution, her game was co-opted, commercialized, and twisted into something she warned against.

A Bootleg Hit That Went Viral

The Landlord’s Game spread like a 1900s meme. College professors, Quaker communities, and left-wing intellectuals played homemade versions, often renaming it Monopoly. Over time, players tweaked the game—introducing the Atlantic City street names we know today.

Enter Charles Darrow. In the early 1930s, Darrow learned of the game through friends, saw an opportunity, and essentially copied it. He added polished designs, sold them to Parker Brothers, and claimed he invented them. Darrow became a millionaire. Lizzie Magie got a mere $500 from Parker Brothers and faded into obscurity.

The Monopoly Monopoly

Parker Brothers, and later Hasbro, propagated the myth of Darrow’s rags-to-riches story. Monopoly became a global phenomenon, selling over 250 million copies worldwide, generating billions in revenue, and inspiring digital versions like Monopoly Go, which raked in $1 billion in revenue in 2023 alone.

The game’s original anti-monopolist messaging was buried under decades of marketing. Instead of serving as a warning against exploitative landlords and monopolies, it became a celebration of ruthless capitalism. The irony is almost too rich.

The Legal Showdown That Unearthed the Truth

Monopoly’s true history may have stayed buried if not for Ralph Anspach, an economist who created Anti-Monopoly in the 1970s. Parker Brothers sued him, and Anspach uncovered Lizzie Magie’s forgotten legacy in his legal battle. After a decade-long fight, Anspach won, and Magie’s name was finally reinserted into Monopoly’s history.

The Game That Defines Real Estate

For real estate professionals, Monopoly offers a condensed—and highly dramatized—lesson in property speculation, rent-seeking, and asset appreciation. If you ever doubted real estate’s power, consider this: Monopoly has been banned in multiple countries, including Cuba and the Soviet Union, for being too capitalist. Meanwhile, real-world landlords and developers are playing the ultimate version of Monopoly every day.

So next time you pass Go and collect $200, remember that the game was never meant to celebrate property empires. It was a warning. And if you own Boardwalk and Park Place, just know you’re exactly the kind of landlord Lizzie Magie tried to warn us about.

SNIPPETS

1️⃣ Offices Go Residential, Baby! Office-to-apartment conversions are surging nationwide, with the number of potential units skyrocketing from 23,100 in 2022 to a record-breaking 70,700 in 2025. New York leads the pack with 8,310 potential units, followed by Washington, D.C. (6,533 units) and Los Angeles (4,388 units), representing almost 42% of nearly 169,000 future adaptive reuse projects. This shift is driven by remote work trends, housing shortages, and the increasing feasibility of repurposing newer office buildings constructed between the 1990s and 2010s. (RentCafe)

2️⃣ Tax Exodus: States like South Carolina, Texas, North Carolina, Florida, and Tennessee are experiencing significant inbound migration, while California, Massachusetts, New Jersey, New York, and Illinois are seeing substantial outbound movement. The data consistently shows that states with lower tax burdens—particularly those with no or low-income taxes, like Tennessee, Nevada, Florida, and Texas—are attracting more residents. The post-pandemic rise of remote work has amplified this trend, giving professionals more geographic flexibility. Notably, 20 of the top 25 states in tax competitiveness experienced net inbound migration, suggesting that tax structure plays a meaningful role in relocation decisions. (Tax Foundation)

3️⃣ Housing Hemmorhage: With 5.2 months of housing supply—the highest since early 2019—the market is trending towards buyer-friendly conditions, characterized by homes sitting longer (54 days on market) and fewer competitive bidding scenarios. The median home price has increased 4.8% year-over-year to $377,125, while the median monthly mortgage payment has reached $2,753, just shy of the April record. Pending home sales have declined 9.4%, reflecting buyer hesitancy due to high mortgage rates (hovering near 7%) and elevated prices. Regional variations are significant, with metros like Pittsburgh seeing the highest price increases (19.3%) and San Francisco experiencing declines (-5.6%). (Redfin)

4️⃣ Rent Rollercoaster: The national average rent for 3-bedroom single-family homes reached $2,357, with annual growth decelerating to just 0.8% - the smallest increase in recent years. Key insights include record-high % vacancy rates of 6%, putting downward pressure on rents, significant regional disparities (Midwest rents grew 5.26% while Southwest saw a slight -0.09% decline), and notable market variations. Coastal California markets remain the most expensive, with San Francisco leading at $5,265, while Midwest cities like Toledo, OH, offer the most affordable options at $1,217. (Rentometer)

5️⃣ Coastal vs. Heartland: While the national median mortgage payment is $2,971, the Midwest and Southern states offer significantly more affordable housing, with West Virginia leading the pack at just $1,838 monthly. The top 10 lowest-payment states (all in the South and Midwest) have median home prices ranging from $249,000 to $291,000, compared to coastal states like Hawaii ($5,904 monthly), Massachusetts ($5,406) and California ($5,277), where median home prices exceed $700,000. Experts warn that even these affordable markets are experiencing rising home prices, which could impact future investment potential. Investors should pay attention to these emerging markets, where lower entry costs and potential appreciation could offer attractive long-term returns. (Realtor.com)

6️⃣ Office Space Shenanigans: The top 100 office leases actually expanded in 2024, growing to 28.9 million square feet from 26.8 million in 2023 - an 8% increase, though still below pre-pandemic 2019 levels. The tech sector is driving this recovery, with tech companies jumping from 11 to 29 of the largest leases, largely propelled by AI-focused firms. Employers are betting on premium, amenity-rich office spaces in strategic locations to entice workers back, signaling a potential shift in the work-from-home paradigm. (Axios)