💼 Title

briefcase | invest smarter

In Today’s Issue…

The Supreme Court just ruled against excessive development fees because nothing says 'American Dream' like fighting for your right to not get financially gut-punched by your local government whenever you want to dig a hole.

Miami and New York are having an office comeback moment, almost reaching pre-pandemic office attendance. It's like watching a '90s boy band reunion – slightly older and wiser but still missing a few key members.

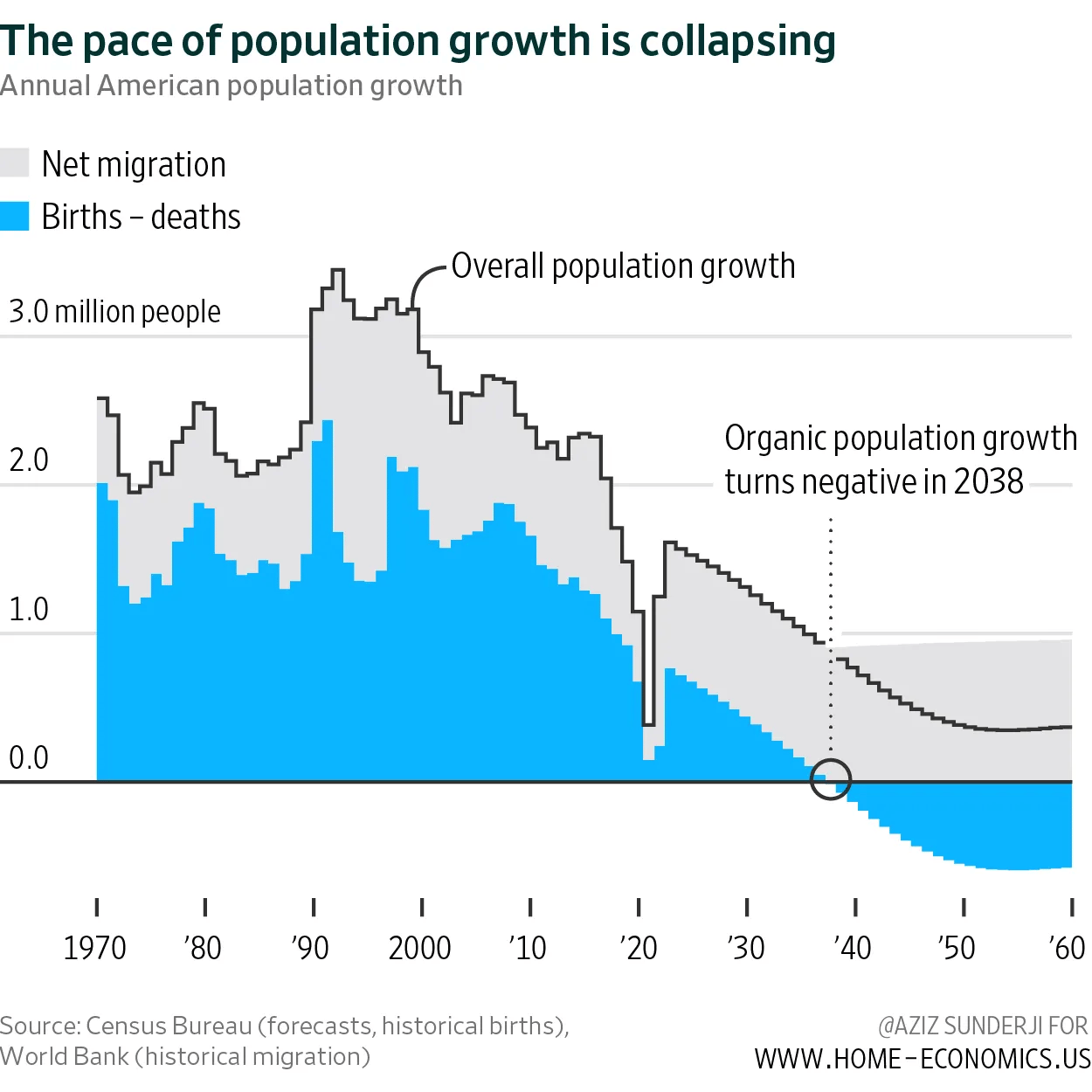

Despite a recent immigration bump, the U.S. is growing slower than a tech billionaire's sympathy at a Senate hearing.

MAIN STORY

In a recent ruling, the U.S. Supreme Court delivered a significant victory for property rights in land development, reshaping the landscape for real estate developers and investors nationwide. This ruling will have far-reaching implications, particularly in permit approvals and local governments' imposition of development fees.

The legal decision may even reduce housing costs, proving once again that the best way to lower prices is through years of legal battles, millions in attorney fees, and a sternly worded Supreme Court decision.

It's just that easy, folks!

The first ruling, stemming from the case of Sheetz v. County of El Dorado, centered on a California landowner's challenge against exorbitant development fees imposed by local authorities.

George Sheetz, seeking to build a modest manufactured home on his property, was confronted with a hefty $23,000 "traffic impact fee study" mandated by the county.

Now, $23,000 for a traffic study! You could buy a car for that, drive it until it breaks down, and still have money left to hire a team of people to carry you around in a sedan chair like a Roman emperor. And guess what? You'd still cause less traffic than the guy trying to build a home without your absurd fee.

At that price, I expect the traffic lights to thank me by name every time I drive past personally. 'Thank you, George, for funding my existence. Please, enjoy a green light!'

Moving on…

Sheetz, backed by the National Association of Realtors (NAR) and other housing groups, argued that such fees infringed upon property rights protected by the Fifth Amendment's Takings Clause.

In a landmark decision, the Supreme Court affirmed that the government cannot demand disproportionate fees as a condition for building permits. Justice Amy Coney Barrett, writing for the unanimous court, emphasized that property rights must be upheld regardless of whether permit conditions are legislatively or administratively imposed. This ruling strikes a blow against what critics have termed "unconstitutional conditions" and provides a legal precedent for challenging excessive fees imposed by local jurisdictions.

This ruling has profound ramifications for developers and home builders nationwide. It allows them to contest fees commonly levied by cities and counties to fund public improvements and infrastructure projects.

Furthermore, the ruling underscores the broader significance of property rights in the context of housing affordability and market dynamics. Impact fees, which can amount to tens of thousands of dollars per property, have been cited as a significant barrier to homeownership, particularly in high-cost regions like California. With the average impact fee for single-family homes exceeding $13,000 nationally and soaring above $37,000 in California, these fees contribute to the escalating costs of real estate and exacerbate housing shortages.

Looking ahead, these rulings' implications extend beyond legal precedent. They signal a renewed commitment to fostering an environment conducive to real estate investment and innovation that balances property owners' interests with the imperative of sustainable development.

As the real estate landscape continues to evolve, stakeholders can draw confidence from the Supreme Court's steadfast defense of property rights and its recognition of their paramount importance in shaping the future of land development in the United States.

HEADLINES

Comeback Tour: Nationwide office visits in March were at some of the highest levels since the pandemic began, with a 32.7% drop compared to March 2019, according to a Placer.ai report. Miami and New York led in-office visit recovery, with visit gaps of 14.1% and 17.2%, respectively. The national visit gap year-over-year dropped slightly from a 36.3% decline in March 2023 to a 32.7% drop in March 2024. A 2024 VTS Global Landlord report revealed that 82% of landlords are seeing the length of lease renewals increasing or holding steady, and 57% of surveyed landlords are prioritizing tenant retention. However, San Francisco office visits were down 50.1% in March compared to pre-pandemic levels, with Los Angeles and Houston down 40.7% and 40.6% respectively. (Bisnow)

Where’s Allentown? A report from Markerr predicts that tertiary markets will see the most rent growth over the next five years, with Allentown, PA, and Wichita, KS, leading the top 100 markets with a projected growth of 4.2% each. Bridgeport, CT, and Greenville, SC, follow at 3.9%, and Syracuse and Albany are projected to grow at 3.8%. Coastal markets are expected to underperform. (Globe St)

Demographics are Destiny: From 2010 to 2020, U.S. population growth slowed dramatically to 7.4%, the lowest rate since the Great Depression, with expectations to increase by only 1 million annually by 2030—down from 3 million in the 1990s. Despite this, recent surges in migration have temporarily boosted population figures, with estimates for 2023 up to 2.5 million, largely from unauthorized immigration. This short-term increase aids economic growth but contrasts with a long-term slowdown due to declining fertility rates, now at a historic low of 1.64 children per woman. While slower population growth and an aging demographic might ease housing market pressures, they could also lead to economic downturns in regions with declining populations, affecting tax revenue and services. (Home Economics)

BY THE NUMBERS

43.7%: U.S. multifamily developments of more than five units saw a 43.7% drop in starts in March 2024 compared to the same month in 2023, according to the Census Bureau and the Department of Housing and Urban Development. The annualized rate of apartments started in March 2024 at 290,000 units, down from 515,000 units a year earlier. Permitting for apartments fell 17.5% year-over-year in March but increased 0.8% from February. Single-family home starts rose 21.2% annually but fell 12.4% from the previous month. Despite the decrease in apartment starts, the number of completed units is increasing due to higher construction rates in recent years. Shelter inflation, including apartment rents and mortgage costs, rose 5.7% in March from a year earlier, higher than the average of about 3.3% from 2015 to 2019. (Bisnow)

38%: A Redfin found that 38% of U.S. homeowners could not afford to buy their current homes today due to the significant rise in home prices and elevated mortgage rates. The survey included 1,988 homeowners, with 59% having owned their homes for over ten years and 21% for at least five years, witnessing their neighborhood's median home-sale price doubling over the past decade and increasing nearly 50% in just the last five years. Factors contributing to this surge include the pandemic-driven demand spurred by remote work and low mortgage rates, a prolonged housing supply shortage, and increased demand from a strong labor market and growing population. (Redfin)

8.8%: In March, new home sales increased by 8.8% to 693,000 annual sales, surpassing last year’s figures by 8.3%, despite mortgage rates hovering around 7%. Sales rose across all regions, with the Northeast leading. New home inventory also grew, making up 29.5% of all listings, although only 19.1% were move-in ready. The broader housing market showed increased inventory and moderated seller expectations, reducing bidding wars. The median new home sale price was $430,700, slightly down from last year, as builders shifted towards more affordable, smaller homes to meet market demands. (Realtor.com)