💼 August 17th: Commission Impossible

briefcase | invest smarter

In Today’s Issue…

The real estate market is about to get a shakeup, and some are calling it the biggest change in a century. I guess that’s true if you ignore, you know, the Great Depression, the housing crisis, and the invention of Zillow.

We explore how the White House is throwing $100 million at housing construction like it's trying to win an HGTV competition, all while hoping that maybe, just maybe, someone will finally start building something affordable.

And in California, where permits for ADUs are handed out like participation trophies, we'll see why nearly half of these 'solutions' end up as nothing more than theoretical backyard dreams.

MAIN STORY

Tomorrow, the real estate industry is set for one of its biggest shakeups in over a century. While it might seem like just another date on the calendar, August 17 is poised to be a watershed moment for homebuyers, sellers, and the agents who guide them.

As new rules, born from a $418 million settlement between the National Association of Realtors (NAR) and a group of disgruntled plaintiffs, come into effect, the reverberations could fundamentally alter how real estate deals get done in America.

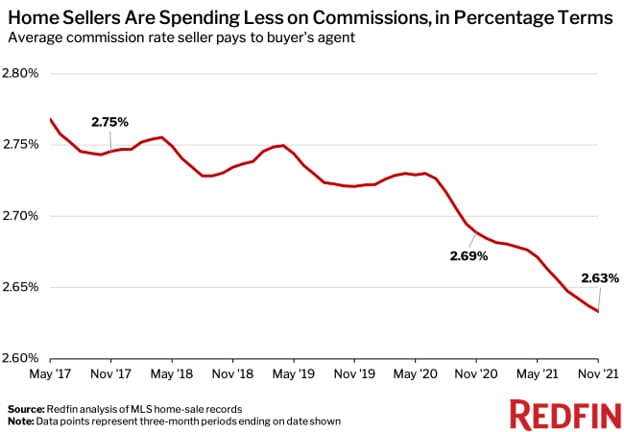

For decades, real estate agents have thrived under a somewhat opaque system where the home seller typically foots the bill for both their own agent and the buyer’s agent. The standard commission, hovering between 5% and 6%, was often baked into the home’s listing price, leading to what many argue were artificially inflated prices.

But come August 17, that cozy arrangement will be upended. Agents will now be required to negotiate their fees directly with buyers, and those fees will no longer be casually advertised in the multiple listing services (MLS) that agents rely on.

"This is a Grand Social Experiment"

“This is a grand social experiment in an industry at scale,” says Leo Pareja, CEO of eXp Realty. His sentiment captures the trepidation of many in the industry, who have been scrambling to adapt to the new landscape. “I’m bracing my agents for what I call the ‘messy middle.’ I fully expect a lot of confusion.”

Confusion might be an understatement. Under the new rules, agents representing buyers must now hash out their compensation upfront, requiring a signed agreement before a prospective buyer even steps inside a property. This is a marked departure from the old norm, where buyers often didn’t worry about their agent’s fee, assuming the seller would cover it.

The End of Free Lunches for Buyers?

Traditionally, buyers have enjoyed what could be seen as a “free lunch”—getting professional representation without directly paying for it. But as the new rules take hold, that lunch is about to get a lot pricier, potentially pushing some would-be buyers to reconsider whether they need an agent.

Mary Schumann, a seasoned Realtor from Minnesota, isn’t panicking just yet. “We already do buyers agreements here, and this doesn’t seem to be incredibly different,” she remarks, pointing out that several states have long required such agreements. However, she also notes that the industry-wide implementation of these changes could weed out less experienced agents. “I think more agents will fall off because some people don’t like change.”

A New Frontier for Real Estate Models

Beyond the immediate impacts on traditional agents, these changes could usher in a new era for alternative real estate models. Flat-fee and discount brokerages are already eyeing this as an opportunity to grab market share from full-service agents. According to a March analysis by TD Cowen Insights, real estate commissions could fall between 25% and 50% due to the new rules.

Shelly Cofini, Chief Strategy Officer at Redy, a marketplace where agents bid on home listings, sees nothing but upside. “This is part of this notion of shifting how real estate is always done,” she explains. “Because agents are in control of the proposal process, they decide on the cash incentive they’ll offer and they decide on the commission structure they’re willing to offer.”

Flyhomes, another innovative player, has already jumped ahead of the curve by launching an AI chatbot designed to answer questions that buyers might traditionally ask their Realtor. “Consumers don’t know this is coming,” says Adam Hopson, Flyhomes’ Chief Strategy Officer. “When they decide they want to buy a home and they find they have to sign a contract, they may say, ‘whoa, what is this?’ We think this will drive them to find information from other sources. We will be one of those sources.”

The Final Countdown

As the clock ticks down to August 17, Realtors and the broader housing market are bracing for impact. While some see this as a chance to innovate, others worry about the growing pains that inevitably accompany such a drastic overhaul.

NAR’s president, Kevin Sears, is trying to strike an optimistic tone. “These changes help to further empower consumers with clarity and choice when buying and selling a home,” he says. “I am confident in our members’ abilities to prepare for and embrace this evolution of our industry and help to guide consumers in the new landscape.”

Whether this optimism will hold as the dust settles remains to be seen. What’s clear is that August 17 will mark the end of an era and the beginning of what could be a more transparent but potentially more complicated real estate market.

HEADLINES

Airbnb’s Hotel California: Once a popular alternative to traditional accommodations, Airbnb faces declining customer demand and lowered earnings projections. Travelers increasingly turn to hotels due to dissatisfaction with Airbnb's high cleaning fees, checkout chores, and inconsistent quality. The company's competitive edge over hotels has diminished, with the price gap between Airbnb and hotel stays narrowing significantly since 2019. In response, Airbnb CEO Brian Chesky has hinted at expanding hotel offerings on the platform and introducing hotel-like amenities to regain customer loyalty. This shift in traveler preferences highlights the challenges Airbnb faces in maintaining its market position against traditional hospitality options. (BI)

Home Sweet Funding: The White House is launching a $100 million grant program to boost housing construction, part of a broader initiative to address housing supply issues. This move comes amid record levels of housing production, particularly in multifamily units, but a decline in single-family home construction. The grants aim to incentivize state and local governments to eliminate regulatory barriers to housing development. Additional measures include streamlining transit-oriented housing financing and expanding low-cost federal funding for affordable housing. The administration's efforts reflect a recognition of housing's critical role in household budgets and the need for continued support in increasing housing supply across the nation. (Bloomberg)

ADU-tiful Housing Solution: Despite several states implementing accessory dwelling unit (ADU) mandates, California remains the leader in ADU construction, with nearly 23,000 units built in 2023. However, the trend reveals a significant gap between permits issued and actual construction, with 40% of permitted ADUs in California from 2019-2023 not being built. This discrepancy may be attributed to speculative permits that increase property value without immediate construction plans. While ADUs are promoted as a potential solution to housing shortages and affordability issues, current projects focus on high-end developments, raising questions about their effectiveness in addressing broader housing challenges. (John Burns)

BY THE NUMBERS

122: U.S. store closings have surpassed openings for the first time in 2024, with 122 net closures reported by Coresight Research. This shift is attributed to a surge in retailer bankruptcies and financial difficulties, particularly in the furniture and home goods sectors. Despite the increase in closures, retail analysts maintain that demand for retail space still outstrips supply, with the national retail vacancy rate at a tight 4.1%. While some retailers are struggling, others, like Dollar General and Burlington Stores, continue to expand. The current trend reflects sector-specific weaknesses, especially in the housing market slowdown, rather than a broader retail apocalypse. (CoStar)

$250: Mortgage rates may have dipped, bringing the average U.S. housing payment down to its lowest level in six months, but it seems homebuyers aren’t exactly racing to the finish line. Despite a $250 drop in payments since spring and a growing inventory of homes, pending sales are still down 5% yearly. Buyers are hesitant, caught in a tug-of-war between slightly more affordable payments and sky-high prices, all while anxiously watching economic and political clouds on the horizon. It’s a case of “great news, but... let’s wait and see.” (Redfin)

0.4%: The latest CPI report has everyone groaning over the one thing that's still inflating faster than a deflated balloon—housing costs. Despite hopes that rent inflation would finally chill out, shelter costs jumped 0.4% in July, almost 90% of the CPI increase. It's like the Fed’s been cramming for a housing test, but the answers won’t stick. With rent growth taking its sweet time to slow down, economists are stuck waiting for the market to catch up, which could take longer than anyone hoped. Until then, it’s a tough pill to swallow—just like rent prices. (Yahoo! News)