💼 Soft on Soft Landings

briefcase | invest smarter

Together With

65% of real estate investors struggle to understand how their portfolio is performing. Feels familiar doesn’t it? Luckily, there’s a solution for that and it’s a tool the Briefcase team is excited to be partnered with. It’s called Tractic. In one app, manage your bookkeeping, track performance of your assets, and gain clarity to make data-driven decisions. Say goodbye to annoying spreadsheets and formulas when you work with Tractic.

In Today’s Issue…

Jamie Dimon's suggestion that the economy might not have a soft landing is like a pilot over the intercom saying, 'Folks, buckle up—I've never used brakes before!'

Exploring the unbreakable umbilical cord of real estate: A whopping 75% of Americans desire to live near mom—because nothing says "I'm an adult" like being able to borrow milk by just walking across the street.

The U.S. job market added fewer jobs than a lazy Sunday adds tasks to your to-do list.

MAIN STORY

The Federal Reserve's attempt to achieve a soft landing is like me trying to do yoga. It starts with good intentions but looks like a confused flamingo on a Slip 'N Slide. Soft landing? It's more like a belly flop in slow motion.

As we approach the midpoint of 2024, the U.S. economy's landscape presents a picture of growing uncertainty despite initial hopes of a smooth economic soft landing following aggressive monetary tightening by the Federal Reserve. Recent data, including GDP figures and inflation metrics, suggest that achieving such a soft landing may be more challenging than anticipated.

According to data released by the Commerce Department, the U.S. economy grew at a sluggish 1.6% annualized rate in the first quarter.

This growth rate not only falls below the projections of many economists, who had expected a figure closer to 2.4%, but it also marks a significant slowdown from the 3.4% growth rate observed in the final quarter of 2023.

While slow growth typically suggests room for the Federal Reserve to consider cutting interest rates to stimulate the economy, the persistently high inflation complicates the scenario. Core consumer prices, which exclude volatile food and energy categories, surged to an unexpected 3.7%, signaling that inflationary pressures remain entrenched.

The dilemma is reflected in the cautious approach taken by Fed officials, who appear hesitant to commit to rate cuts in the near term. This caution resonates with the sentiments expressed by JPMorgan CEO Jamie Dimon, who recently voiced skepticism about the likelihood of a soft landing.

"The market is overly optimistic about the economy achieving a soft landing without significant turbulence," Dimon stated in an interview with The Wall Street Journal. He pointed to the "massive fiscal deficit and geopolitical challenges" as factors that muddy the economic outlook.

Jamie Dimon's suggestion that the economy might not have a soft landing is like a pilot over the intercom saying, 'Folks, buckle up—I've never used brakes before!'

Dimon's concerns are echoed by other financial leaders and analysts who see potential headwinds on the horizon. "The U.S. economy is not out of the woods yet," said Maria Ramirez, Chief Strategist at Ramirez & Co. "There are significant challenges ahead, including the potential impact of global tensions and the domestic fiscal situation."

The impact is palpable as real estate markets react to these economic tremors. Commercial real estate, in particular, feels the squeeze from high vacancy rates and shifts toward remote work that dampen demand for office space. Meanwhile, residential real estate seems resilient but faces pressures from rising mortgage rates and affordability issues.

Given these challenges, the Federal Reserve's next moves will be crucial. The central bank is stuck in what KPMG’s chief economist has termed "monetary policy purgatory," deliberating when and if to shift gears towards rate cuts.

Investors and policymakers alike are advised to remain vigilant as the American economy navigates one of its most uncertain phases.

HEADLINES

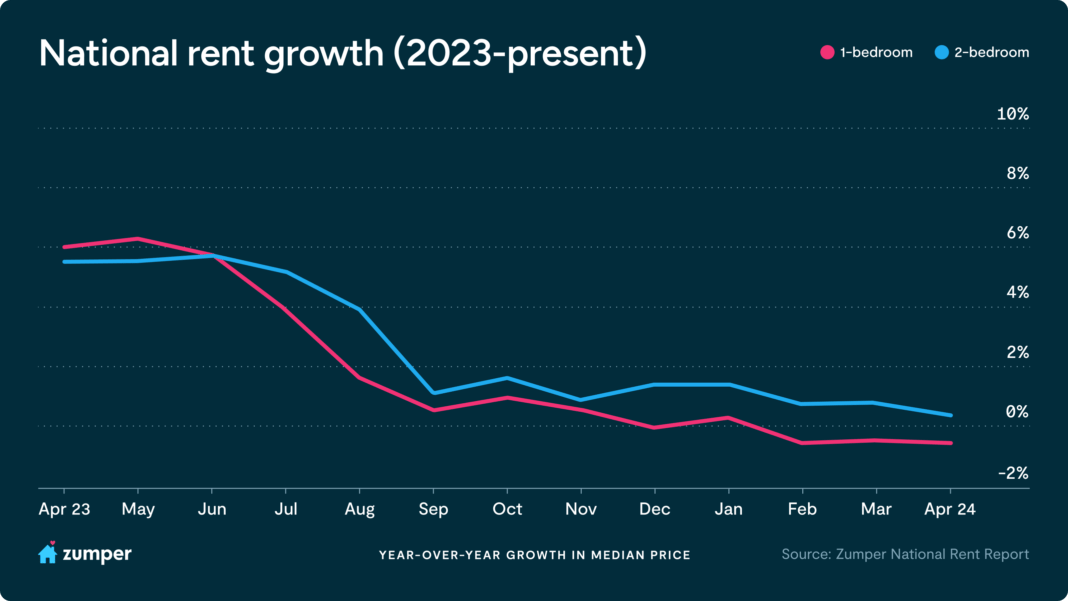

Mama’s Boy: A recent survey by Realtor.com reveals that 75% of Americans would ideally live close to their moms, with 47% having moved or planning to move to achieve this. The study found that 14% moved to be closer to their mom, 15% plan to move, 10% say their mom moved closer to them, and 8% say their mom plans to move. The survey also found that 65% of Americans would move closer to their mom if they could, and 29% have bought or rented a new home to be close to their mom. Among those planning to move, 31% plan to buy or rent a new home near their moms. The report also noted that rents declined for the 8th consecutive month in March, with year-over-year rental prices dropping by -0.3%. (Realtor.com)

Airbnbeats: Airbnb surpassed first-quarter earnings expectations, with revenues rising 18% to $2.14 billion and net income increasing to $264 million, or 41 cents per share. However, the company provided weaker-than-expected guidance for the upcoming quarter, projecting revenues between $2.68 billion and $2.74 billion, slightly below analyst expectations. Despite this, Airbnb is witnessing strong travel demand, especially with upcoming events like the Paris Olympics, and saw significant platform engagement during the North American solar eclipse, hosting 500,000 guests. (CNBC)

Rate Cut? In April, the US economy experienced a significant slowdown in job growth, adding only 175,000 jobs, marking the lowest increase since October of the previous year and falling below the average monthly gain of 245,500 jobs seen so far in 2024. This slowdown aligns with the Federal Reserve's efforts to cool demand amidst high inflation. Despite the lower figures, the market reacted positively, with significant upticks in Dow, S&P 500, and Nasdaq futures. The unemployment rate slightly increased to 3.9%, maintaining a sub-4% level for 27 consecutive months—a record last seen in the late 1960s. Most new jobs were in health care and social assistance, indicating a continuing trend in employment growth within this sector. (CNN)

BY THE NUMBERS

13.8%: Defaults are reaching historic levels in the US office market due to high interest rates and weak demand, with over $38 billion of office buildings threatened by defaults or foreclosures, the highest amount since Q4 2012. The rate of office loans being paid off fell from over 90% in 2021 to 35% in 2023, the worst rate since records began in 2007. The US office vacancy rate is at a record 13.8%, up from 9.4% at the end of 2019. In the next 12 months, $18 billion of office loans will mature, more than double the volume in 2023, and Moody’s projects that 73% of these will be difficult to refinance. This financial upheaval is pressuring US banks and other lenders, with commercial real estate losses causing shock waves on Wall Street. (WSJ)

$383,188: In April, the U.S. housing market saw the median home-sale price increase or remain steady in the 50 largest metros for the first time since July 2022, rising to nearly a record $383,188, a 4.8% increase from the previous year. This price hike is fueled by low inventory levels, despite new listings being up 15% year over year but still below typical for April. As mortgage rates continued to climb, reaching the highest weekly average in five months, the median monthly housing payment surged to a record $2,890, up 15% year over year. Key markets like Anaheim and Detroit saw significant price jumps, driven by affluent and more affordable metros. (Redfin)

0.6%: In April, the national rent index saw one-bedroom rents decrease by 0.6% to $1,486, while two-bedroom rents increased by 0.1% to $1,843. All six North Carolina cities in the report experienced a decline in one-bedroom rent, with Winston Salem seeing the second-largest decrease in the country. New York City, however, saw a 20% increase in rent since last year and a 50% increase since pre-pandemic times, with the tightest rental vacancy rate in decades. Changes to national rent rates are expected to remain modest due to an imbalance between supply and demand. (Zumper)

(VERY) LIGHTER SIDE

Up: In an enchanting twist straight out of a storybook, Airbnb is now listing none other than the iconic floating house from Disney's Up—balloons and whimsy included! That's right, and you can channel your inner Carl Fredricksen and float away (figuratively, of course) in the very abode he crafted with love alongside his late, great Ellie. While the house isn't airborne (yet), it promises adventures galore, from earning Wilderness Explorer badges to stargazing sessions that Ellie would have adored. Ideal for the nostalgic soul or anyone looking to kickstart their own "Adventure Book", this whimsical stay is a heartfelt nod to wanderlust and the wonders of staying in, all rolled into one. (Airbnb)