👋👋 Good morning real estate watchers! Today, we will discuss how the median home price has increased to $412,500, which is now five times the median household income. Five times! That's like saying the cost of a sandwich is five times your daily salary. 'That'll be $800 for your BLT, sir.' 'But I only make $160 a day!' 'Well then, have you considered not being poor? It's really quite simple, just earn more money!’

But first, here’s what we’ve been paying attention to this week…

1️⃣ Commercial on Ice: Commercial real estate lending is experiencing a significant slowdown, with core CRE lending growth dropping to just 1.22% in Q1 2025 and total delinquencies reaching $31.4 billion, representing a 1.70% overall delinquency rate. (Globe St)

2️⃣ Commercial on Ice: The commercial mortgage-backed securities (CMBS) special servicing rate surged to 10.57% in June, marking its highest point since 2013 and representing a dramatic 225 basis point increase over the past year, with office properties leading the downturn at a record 16.38% special servicing rate. (Trepp)

3️⃣ Apartment Musical Chairs: Despite overall positive apartment occupancy trends nationwide at 95.6%, six major markets are experiencing slight occupancy declines, with Lincoln, Nebraska, experiencing the most significant contraction of 100 basis points due to supply outpacing demand. (RealPage)

4️⃣ Media Acquisition: HousingWire has acquired The Builder's Daily, a leading homebuilding publication, as part of its strategy to serve the entire housing ecosystem from construction through real estate and mortgage. (HW)

5️⃣ Nepo-Homebuyers: Nearly one-quarter (23.8%) of Gen Z and millennial homebuyers used family money—either cash gifts or inheritance—to help fund their down payments, making it the second most common funding source after saving directly from paychecks (56.5%). (Redfin)

6️⃣ That’s Not Good: America's housing deficit grew to 4.7 million homes in 2023, increasing by 159,000 homes despite a pandemic construction surge, because the 1.4 million new homes built couldn't keep pace with the 1.8 million new families formed. As a result, 8.1 million families currently share homes with unrelated people while only 3.4 million homes are available for rent or sale. (Zillow)

TOP STORY

HARVARD BUZZKILL

Sarah Chen thought she was being practical when she saved $30,000 for a down payment on her first home in Austin. The 29-year-old marketing manager earning $85,000 annually figured that would be enough to break into homeownership. She was wrong by about $97,000. According to new calculations, she'd need an annual income of $126,700 to afford the monthly payments on today's median-priced home.

Chen's predicament illustrates the central finding of the Harvard Joint Center for Housing Studies' latest "State of the Nation's Housing" report: America's housing market has fundamentally diverged from economic reality. The median existing single-family home price has rocketed to $412,500, a staggering five times the median household income, and well above the traditional affordability benchmark of three times the income.

"This is a shocking five times the median household income and significantly above the price-to-income ratio of 3 that has traditionally been considered affordable," the Harvard researchers note in their analysis.

The Numbers Don't Lie (But They Do Sting)

The data paints a picture of a market in crisis. Home prices have surged 60% since 2019 and continue to climb at an annual rate of 3.9%, even as existing home sales plummeted to a 30-year low of just 4.06 million transactions, the fewest since 1995. It's the housing equivalent of a luxury car lot, where everyone's window-shopping but nobody's buying.

For investors, the implications point to an increasing number of renters. The traditional first-time buyer market has essentially vanished. Only 6 million of the nation's nearly 46 million renters can now afford the monthly payment on a median-priced home, assuming standard lending terms. Between 2021 and 2024, the number of income-eligible Black and Hispanic renter households dropped by 65% and 62% respectively.

"The growth of new home sales reflected rising construction levels," the report notes, but even builders are struggling. The median size of new single-family homes has shrunk for three consecutive years to 2,150 square feet as builders desperately try to hit lower price points.

The Rental Reality Check

That said, if homeownership feels like reaching for the moon, renting isn't exactly a bargain basement experience either. A record 22.6 million renters—fully half of all renters—are now cost-burdened, spending more than 30% of their income on housing. For those earning under $30,000, the situation borders on mathematical impossibility: they have a median of just $250 per month left after paying rent.

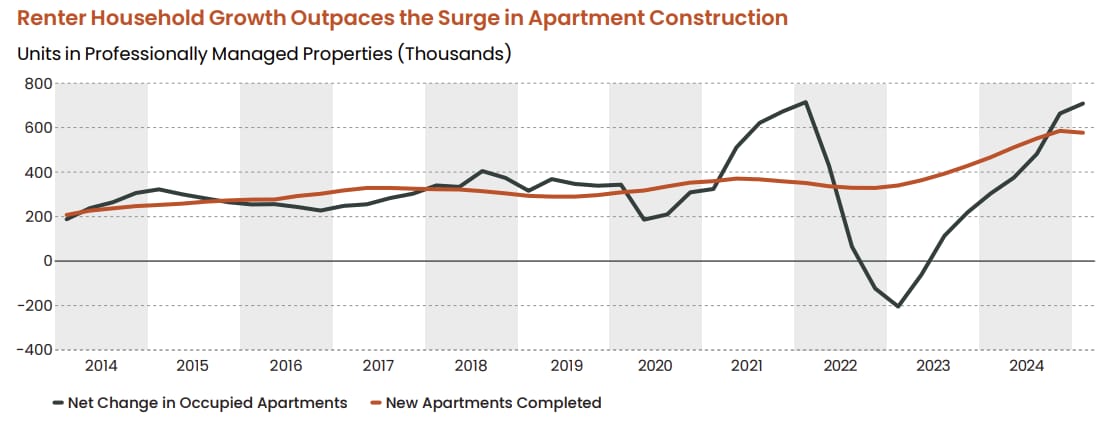

The rental market did see unprecedented construction activity, with 608,000 multifamily units completed in 2024, the most in nearly four decades. But here's the cruel irony: While developers built more apartments than at any time since the 1980s, the stock of units renting for under $1,000 fell by more than 30% since 2013.

Inflation, ammiright?

Demographic Headwinds Gathering

Concerning long-term real estate investors is the demographic picture reported on by the brainiacs at Harvard. Net household growth decelerated for the second straight year, dropping to 1.26 million households annually by the first quarter of 2025. The immigration surge that fueled much of the recent housing demand has ended, "removing the largest source of population growth."

The report projects that household growth will slow dramatically over the next two decades, with just 8.6 million net new households forming between 2025 and 2035, substantially lower than the 13.5 million that formed in the 1990s and the 10.1 million that formed in the 2010s, respectively.

Geographic Arbitrage Opportunities

Not all markets are created equal, and savvy investors are taking note. While rents rose modestly nationwide at 0.8% annually in early 2025, the variations were dramatic. Markets with the most new construction saw rents drop an average of 2.5%, while those with minimal building experienced 2.9% increases.

Cape Coral, Florida, topped the cost-burdened charts with 65% of renters facing financial strain, while Austin saw rents decline by 6.9% as new supply flooded the market. The lesson for investors: follow the construction cranes, but in reverse.

Climate Costs Mount

Adding insult to injury, climate disasters resulted in more than $180 billion in damages during 2024, encompassing 27 billion-dollar weather events. More than 20,000 homes suffered significant damage or were destroyed by Hurricane Helene and recent wildfires. Insurance premiums jumped 57% from 2019 to 2024, with some Miami homeowners now paying over $11,000 annually for coverage.

Eleven thousand dollars! That's more than some people make in three months, to insure against the possibility that climate change might personally visit your house like an unwelcome relative who drinks all your beer and sets everything on fire.

Investment Implications

For real estate investors, the Harvard report suggests that the market is bifurcating along income lines. Single-family rental construction reached a record 93,000 units in 2024, with investors purchasing nearly a third of single-family homes sold in the first quarter of 2025, up from 19% in 2019.

The build-to-rent sector appears particularly attractive, offering larger homes suitable for families priced out of homeownership. New single-family rentals averaged 2.7 people per unit, compared to just 1.7 for apartments, while commanding monthly rents of $2,230.

However, the demographic headwinds and slowing household formation suggest investors should prepare for a fundamentally different market ahead, one where housing demand grows more slowly and affordability constraints reshape traditional investment strategies.

As Sarah Chen discovered in Austin, the American Dream hasn't disappeared; it has simply become more expensive.