👋👋 Good morning real estate watchers! Today, we are going to talk about how Americans are staying in their homes so long it’s less a real estate market and more a witness protection program. People aren’t moving cities, they’re moving from the living room to the kitchen and calling it a ‘lifestyle change.’

But first, here’s what we’ve been paying attention to this week…

1️⃣ Credit Crunchers: A shocking 1 in 4 U.S. adults now carry a subprime credit score below 660, signaling growing financial strain for millions. In other words, the economy isn’t just feeling the pinch; Americans’ credit is too. (Apollo)

2️⃣ Rent Gap: Even after years of record apartment construction, new units are still commanding higher rents than older buildings; about a 6% premium nationwide. In cities like Memphis and Detroit, the gap is massive, with new lease-ups renting for nearly 80% more. (Globe St)

3️⃣ Investor Shuffle: Investors bought 10.8% of all U.S. homes in Q2 2025, with buying slightly outpacing selling as small investors hit their highest market share since 2007. Missouri, Mississippi, and Nevada saw the most investor activity. (Realtor.com)

4️⃣ Left Turn: Zohran Mamdani’s mayoral win has New York’s commercial real estate world bracing for rent freezes, affordability mandates, and progressive housing reforms; though insiders expect more compromise than revolution. Developers worry about rent-stabilized units and reinvestment limits, while Mamdani pushes a plan for 200,000 new, mostly affordable homes backed by $100 billion in capital funding and faster approvals. (CRE Daily)

5️⃣ Renter Perks: Renters are negotiating harder than ever: 58% say concessions were offered upfront, and 25% negotiated their own, with reduced rent and free months topping the list. Digital touring matters too, with 57% of recent renters saying features like virtual staging or 3D amenity tours are now essential in choosing a home. (Zillow)

TOP STORY

STAY PUT

In West Palm Beach, a bungalow that once changed hands every few years has been occupied by the same couple for over a decade. Their reason is simple: “We’d love a yard with less grass and more shade,” the homeowner said, “but not at 6% mortgage rates.”

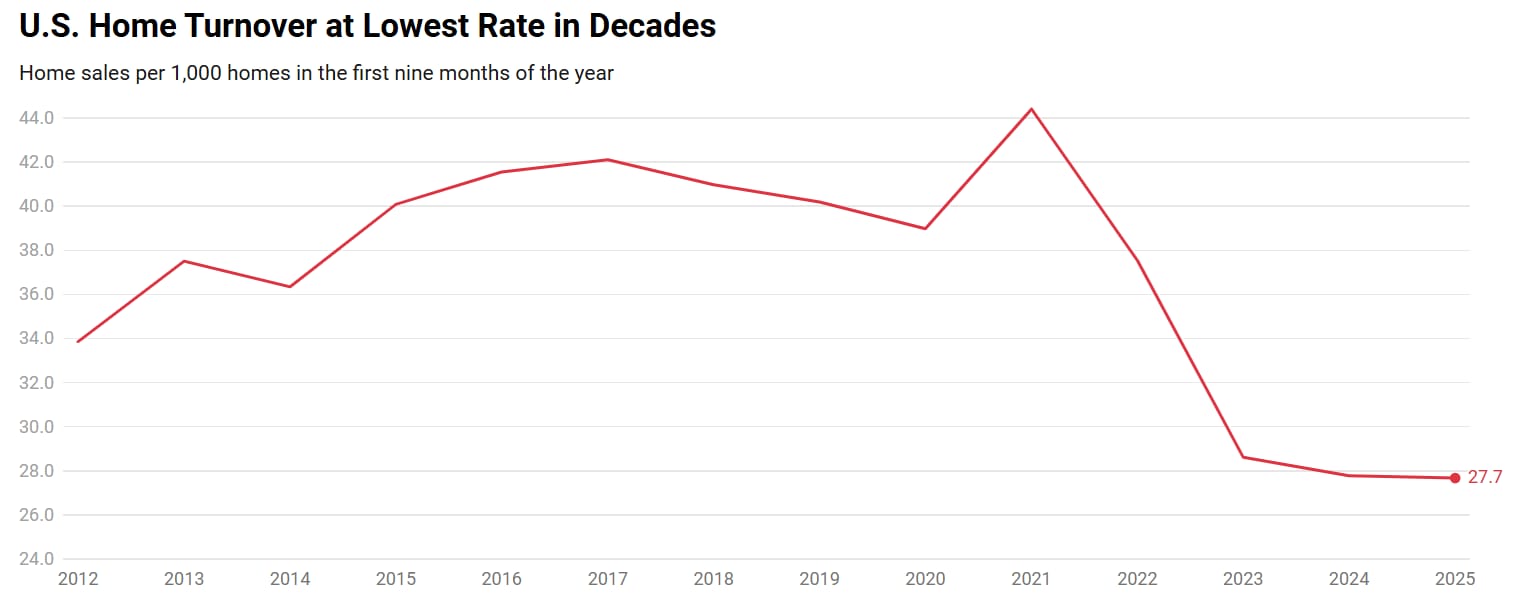

Multiply that hesitation nationwide and you get a housing market defined less by bidding wars and more by long-term nesting. According to a new Redfin analysis of MLS and county-record data, only 28 out of every 1,000 U.S. homes, or 2.8%, changed hands in the first nine months of 2025, marking the lowest turnover rate in at least 30 years.

2.8%! Statistically, there is a higher chance of being bitten by a New Yorker on the subway. And honestly, both events are equally traumatic.

During the 2021 pandemic peak, the rate was 44 out of every 1,000 homes. Today, turnover is down 37.7% from that frenzy and down 31.2% from 2019, the last pre-pandemic year.

America is not a nation of movers anymore. They’re are a nation of stay-putters.

Low Mobility Meets High Uncertainty

“America’s housing market is defined right now by caution,” said Chen Zhao, Redfin’s head of economics research. And the data agrees.

Three forces are freezing the market:

Affordability has collapsed. Home prices remain near record highs while borrowing costs hover above 6%. Sellers outnumber buyers, but many buyers are staying home, quite literally.

The mortgage rate trap. More than 70% of U.S. homeowners hold a mortgage with an interest rate below 5%, making the idea of trading up (or down) financially unappealing. Why move to pay twice the rate for the same walls and a slightly bigger backyard? Asking someone to leave a 2.9% mortgage is like asking them to trade in their Tesla for a rusty Honda Civic and a handful of Skittles. Hard pass.

Economic anxiety. “Job security, inflation, instability,” Zhao noted. Even buyers who can afford a home are pausing. Deals are falling apart not because buyers can’t qualify, but because they’re getting cold feet.

In a market where both sides hesitate, mobility stops. A frozen market isn’t dramatic, but it is historically rare.

Listings Have Tickled Up, But Only Slightly

Sellers are tiptoeing back in, but quietly. 39 out of every 1,000 homes were listed for sale this year, up from last year, but still the third-slowest listing rate since 2012. Compared to 2019, new listings are down 25.2%.

And where homeowners do move, it’s largely single-family owners. About 30 of every 1,000 single-family homes sold this year, versus 22 of every 1,000 condos/townhouses. Redfin estimates that in August there were 72.3% more condo sellers than buyers, making condo owners the wallflowers of the market: dressed to sell, but no one’s asking for a dance.

Where People Are Actually Moving

There are exceptions. Virginia Beach led the nation, with 35.2 sales per 1,000 homes, one of only three major metros where turnover increased year-over-year. West Palm Beach, Tampa, Indianapolis, and Atlanta also topped the list.

But the real story is in the markets where movement has nearly stopped. New York posted the lowest turnover of the top 50 metros, followed closely by Los Angeles and other California cities where affordability challenges collide with entrenched homeowners who secured sub-3% mortgage rates during the pandemic.

In parts of the Sun Belt (once the pandemic migration darlings), demand has cooled sharply. San Antonio's turnover rate plunged 26.9%, the largest drop among major metros. Charlotte, Jacksonville, Miami, and Orlando all saw double-digit declines.

The pandemic boomtowns are now the pandemic “stay-put” towns.

What Declining Mobility Means Long-Term

Housing mobility is a quiet economic engine. When people move, they spend on renovations, appliances, movers, repairs, cars, and restaurants. When they don’t, those dollars vanish.

Low turnover also shrinks inventory. Fewer sellers means fewer homes for new families, first-time buyers, or workers relocating for jobs. For cities losing momentum (San Antonio, Charlotte, Jacksonville) that slowdown can ripple into construction, employment, and tax revenues.

But the biggest consequence: Price rigidity. If no one is forced to sell, prices don’t fall, no matter how high mortgage rates climb. House-rich, rate-locked owners simply stay put. In economics, that’s called inelastic supply. In plain English, it’s called your neighbor who refuses to move until rates return to 3%.

America isn’t just short on housing supply; it’s short on housing movement.

And until either prices fall, rates drop, or certainty returns, buyers and sellers may remain in the same standoff they’ve held for two years.

Mobility used to define the U.S. housing market. Now, inertia does.

Welcome to The Great Stay-Put Era, where nobody’s moving, but everyone’s watching.