💼 Rise of Built-to-Rent

briefcase | invest smarter

In Today’s Issue…

So, apparently, there's a new trend in real estate: build-to-rent homes. It's like a timeshare, but instead of sharing, you just pay rent forever. It's the 'buy one, never own' model!

The stock market is on such a high, it might as well be popping champagne. With inflation cooling down, even the Dow is feeling a bit tipsy, up by 350 points

Panorama Mortgage Group introduces a 1% down payment program for first-time homebuyers. It's the housing market equivalent of finding a unicorn – if that unicorn also gave you a 2% grant and a pat on the back for good measure.

MAIN STORY

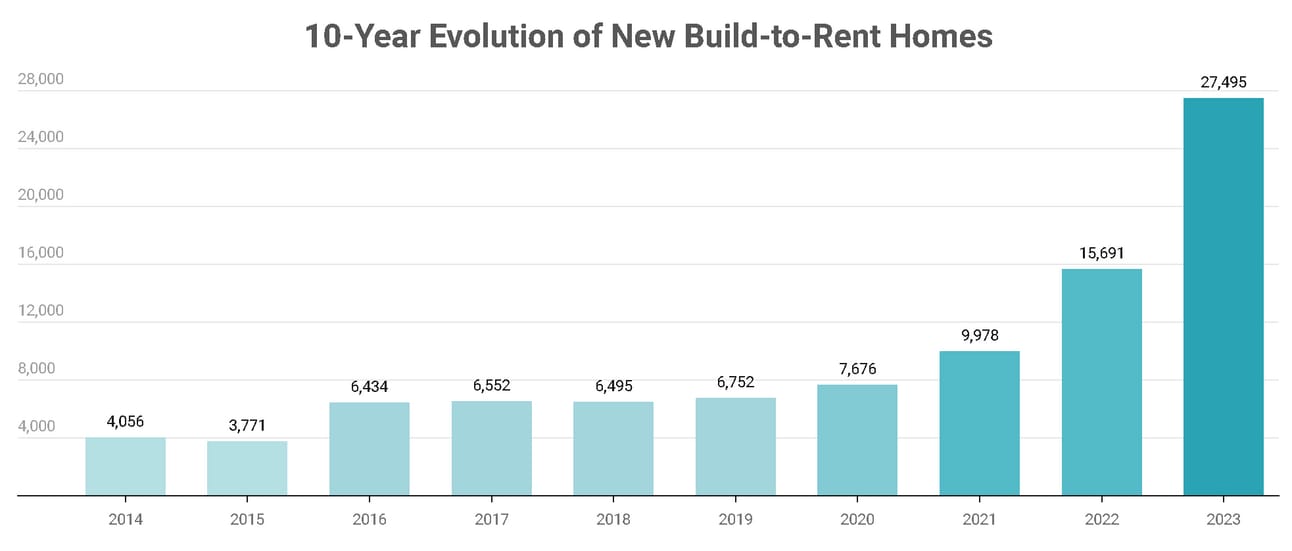

As the real estate landscape continues to evolve, data from RentCafe reveals a staggering rise in build-to-rent housing, offering valuable insights for investors navigating this booming market. Here are the top five takeaways for real estate investors:

📈 Record-Breaking Growth: Build-to-rent homes witnessed an unprecedented surge in 2023, with nearly 27,500 houses completed nationwide. This marks a remarkable 75% increase from the previous year and underscores the robust demand for single-family rentals.

📌 Prime Investment Locations: Phoenix, Dallas, and Atlanta emerge as the top three metros for build-to-rent construction, collectively accounting for almost one-third of all units added in 2023. These cities offer lucrative opportunities for investors seeking high-demand rental markets with strong growth potential.

🏗️ Continued Expansion: The momentum shows no signs of slowing down, with over 45,400 build-to-rent houses currently under construction. While many of these units are slated for completion in 2025, investors can expect sustained growth in the build-to-rent sector in the coming years.

🗺️ Diversification Beyond Traditional Markets: While the Southwestern region traditionally dominated build-to-rent development, the trend is now expanding to new territories such as Florida and even the Bay Area.

Because what's more Floridian than retiring in a build-to-rent home, where you can enjoy the sunshine and the comfort of knowing you'll never have to fix a leaky roof? It's the retiree's dream: sun, sand, and zero responsibilities!

This diversification gives investors a broader range of investment opportunities in emerging markets with untapped potential.

🤩 Focus on New Construction: Renters are increasingly drawn to newly constructed single-family homes for rent, equipped with modern amenities and spacious layouts. In fact, 41% of build-to-rent homes were built in the last five years, highlighting the appeal of fresh, contemporary rental properties to today's tenants.

In summary, the build-to-rent housing boom presents an unprecedented opportunity for real estate investors to capitalize on the surging demand for single-family rentals. By strategically targeting high-growth markets, diversifying their portfolios, and prioritizing new construction projects, investors can position themselves for success in this thriving sector.

HEADLINES

Inflation Chill Pill: All three major US stock indexes reached record highs on Wednesday after data showed inflation cooled in April. The S&P 500 gained over 1.2% to close at 5,308.15, the Nasdaq Composite rose about 1.4% to 16,742.39, and the Dow Jones Industrial Average increased by 350 points or 0.9% to close at 39,908. The Consumer Price Index showed prices were up 3.4% for the 12 months ended in April, down from 3.5% the previous month. On a monthly basis, prices rose 0.3%, slower than the 0.4% increase two months prior. Core CPI, which excludes energy and food, slowed from 3.8% to 3.6%, its lowest rate since April 2021. (CNN)

Retail Rockstar: The retail market is currently the strongest performing property division among the four leading asset types, with multi-tenant retail space absorption in Q1 totaling 1.4 million square feet, according to Marcus & Millichap. The broader commercial real estate market is generally neutral, with higher interest rates and slowing economic growth impacting demand. The multifamily sector saw a 10-basis point increase in the national vacancy rate due to new unit completions, with nearly 104,000 additional apartment units filled in Q1. (Globe St)

1% Down: Panorama Mortgage Group (PMG) has introduced a new program, the 1st Generation Homebuyer program, which allows first-time homebuyers to secure a loan with a 1% down payment. The program also provides a 2% grant to meet the conventional 3% down payment minimum. The program is designed for borrowers who are the first in their family to buy a home, and the 2% grant does not need to be repaid. No restrictions on property location or census tract make the program available nationwide. (HW)

BY THE NUMBERS

0.6%: U.S. rents increased by 0.6% in April, with the typical rent now at $1,997, according to the Zillow Observed Rent Index. To afford this, a renter must earn nearly $80,000 yearly, up from less than $60,000 five years ago. Since 2019, rents have grown 1.5 times faster than wages. However, strong multifamily construction has helped moderate rent growth, with national rent growth last year at 3.4%, outpaced by wage growth at 4.3%. The share of median household income spent on rent has slightly decreased to 29.2%, down from 30.3% in June 2022. For the first time since July 2023, typical rent for multifamily units outpaced that for single-family homes, with multifamily rents growing 0.631% in April, compared to single-family rents growing 0.625%. (Zillow)

24.2%: In the first quarter of 2024, American families spent an average of 24.2% of their income on mortgage payments, according to a report by the National Association of Realtors. The monthly mortgage payment for a typical single-family home was $2,037, down 5.7% from the previous quarter but up 9.3% from the same period a year ago. First-time buyers spent 36.5% of their income on mortgage payments. The report also found that 68% of the 50 largest U.S. metro areas required a household income of over $100,000 to afford a median-priced home. (Realtor.com)

Sentiment: US consumer sentiment fell to a six-month low in May, dropping to 67.4 from 77.2 in April, according to the University of Michigan’s consumer sentiment index. This is due to high inflation, interest rates, and fears of rising unemployment. Despite this, consumer spending remained strong in the year's first quarter, likely driven by upper-income earners. However, retailers are noticing more caution from lower-income customers. The unemployment rate is currently at a low of 3.9%. Consumer price increases have remained high this year, with prices rising 3.5% in March compared to a year ago. (AP News)

LIGHTER SIDE

Castle of Concrete and Clown Bathrooms: In the Season 5 episode of "Ugliest House in America," comedian Retta tours three homes in the Northern part of the country, including a 1960-built castle in Hartford, WI, a 1940-built multicolored home in St. Cloud, MN, and a 1933-built house in Lake Geneva, WI. Each house presents unique design flaws, such as uncomfortable concrete seating, exposed toilets, excessive use of color, miniaturized bathrooms, and patterned carpeting. After the tours, Retta declares the second house, with its bright teal exterior and pink living room, as the ugliest in the Northern region, advancing it to the semifinals. (Realtor.com)