💼 Forever Renters

briefcase | invest smarter

In Today’s Issue…

Our top story: forever renters. Yes, renting forever. Because if there's one thing millennials love more than avocado toast, it's the thrilling, never-ending joy of paying someone else's mortgage.

Imagine selling your condo for less than you paid because the building is about as sturdy as a Jenga tower at a toddler's birthday party.

The Mortgage Bankers Association thinks we need a National Housing Policy Director to streamline policies. Because nothing says efficiency like adding government bureaucracy.

MAIN STORY

The New York Fed says only 10.1% of renters think getting a mortgage will be easy. That's lower than the percentage of people who think pineapple belongs on pizza.

And let's be honest, even fewer people are right about that.

As housing prices and mortgage rates soar to unprecedented levels, many Americans are resigning to the reality that they may never own a home. This phenomenon, already prevalent in parts of Europe, is gaining traction in North America, where the dream of homeownership is becoming more elusive. Recent surveys highlight a growing pessimism among renters about their chances of buying a home, raising important questions about the future of the real estate market.

Bleak Prospects for Homeownership - A recent Federal Reserve Bank of New York survey reveals that renters' expectations of owning a home have plummeted. In February, renters estimated their probability of homeownership at a mere 40.1%, a significant drop from 44.4% the previous year and the lowest since the survey began in 2015.

The outlook is particularly grim in the Northeast, where the probability dropped to 25.8% from 51.4% last year.

Another Redfin survey found that nearly 40% of renters believe they will never own a home, up from 27% the previous year.

This pessimism is driven primarily by the unaffordability of homes, with nearly half of the respondents citing high home prices as the main obstacle. Other significant barriers include the inability to save for a down payment, unaffordable mortgage payments, and high mortgage rates.

Escalating Costs and Rising Rates - The cost of buying a home has surged dramatically in recent years. Home prices have increased by over 40% since 2019, and the trend shows no signs of slowing. In February alone, national home prices rose 6.4% annually, according to the S&P CoreLogic Case-Shiller Home Price Index. Renters expect this upward trajectory to continue, anticipating a 5.1% increase in housing prices over the next year.

At the same time, mortgage rates have climbed steeply. The average rate on a 30-year fixed mortgage reached 7.22% in early May, the highest since November.

The European Parallel - The trend towards permanent renting in the United States mirrors a long-standing European pattern, where renting is more common than homeownership. In many European countries, cultural and economic factors make renting more viable and accepted long-term. The rising unaffordability of homes in the U.S. pushes more Americans to adopt a similar mindset, where renting is not just a temporary phase but a permanent lifestyle choice.

Implications for the Real Estate Market - The shift towards "forever renters" could have profound implications for the real estate market. As fewer people transition from renting to owning, demand for rental properties will likely increase, potentially driving up rents. This could exacerbate affordability issues, particularly for those struggling to meet monthly rental payments.

HEADLINES

Florida Condo Chaos: In 2019, Ivan Rodriguez, 76, liquidated his 401(k) to buy a 1,500-square-foot condo at the Cricket Club in North Miami for $190,000. Due to a new state law requiring older buildings to meet structural safety standards, the condo board proposed a $30 million special assessment, costing each unit owner over $134,000. Unable to afford this, Rodriguez sold his condo for $110,000, a 42% loss. Miami's real estate market has seen home prices double since 2018, but older condos are now selling for 12% less than in 2020. The Cricket Club, nearly 50 years old, has 40 out of 220 units listed for sale, with little interest. The new law mandates buildings pass structural inspections within 30 years, causing many owners to sell before the January 1 compliance deadline. (WSJ)

Overvalued: According to a Fitch Ratings report on RMBS, U.S. home prices were overvalued by an average of 11.1% in 4Q23, with 90% of metropolitan statistical areas (MSAs) affected, down slightly from 91% in 3Q23. Among these, 56% were overvalued by more than 10%, compared to 58% in the previous quarter. Memphis was the most overvalued metro area among the top 50 by population, followed by Buffalo-Cheektowaga-Niagara Falls, NY, and Indianapolis-Carmel-Anderson, IN. (Globe St)

Housing Czar: Mortgage Bankers Association (MBA) president and CEO Bob Broeksmit proposed the creation of a "National Housing Policy Director" within the White House to streamline housing policies and address regulatory issues. Broeksmit highlighted the inefficiencies caused by multiple regulatory agencies, such as the CFPB and FHFA, and criticized the rapid rollout of new regulations without considering their cumulative impact. He cited HUD's 22 duplicative fees, which have led to a 75% reduction in multifamily loans over two years, and criticized the CFPB's scrutiny of so-called "junk fees." (HW)

BY THE NUMBERS

0.5%: In the first quarter of 2024, investor home purchases in the U.S. rose by 0.5% year-over-year, marking the first increase since mid-2022, with investors buying 19% of homes sold—the highest share in nearly two years. California markets, particularly San Jose and Oakland, saw significant increases of over 20%. Investors are making more money, with the typical home sold in March fetching 55% more ($175,000) than the purchase price, up from 46% ($147,000) a year earlier. Single-family homes comprised 68.9% of investor purchases, and investors bought a record 26% of low-priced homes. High-priced home purchases by investors jumped 10.5%, while the typical home bought by investors cost $464,560, up 9.2% from a year earlier. In San Jose, investor purchases surged 27.8%, while Cincinnati saw the largest decline at 22.1%. (Redfin)

26.6%: The latest U.S. Census Bureau data highlights Celina, TX, as the fastest-growing city, with a 26.6% population increase from July 2022 to July 2023, far surpassing the national growth rate of 0.5%. Texas dominates the list with 8 of the top 15 cities, including Fulshear, Princeton, and Anna, driven by job opportunities, no income tax, and housing construction. Lathrop, CA, the only California city on the list, has the highest median home price at $741,600, while Prosper, TX, tops the list at $919,000. The growth in these cities is attributed to proximity to major urban centers, high-ranking schools, and low crime rates. (Realtor.com)

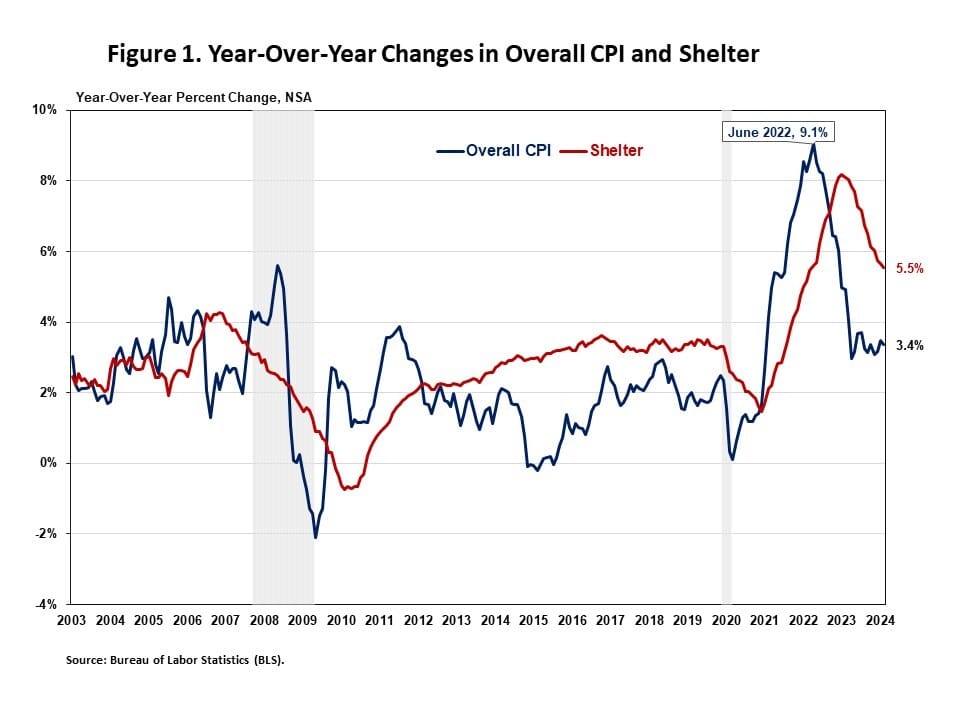

5.5%: In April, overall and core inflation eased slightly, with the Consumer Price Index (CPI) rising by 0.3% on a seasonally adjusted basis, down from 0.4% in March. The shelter index, which rose by 5.5% year-over-year (YOY) and 0.4% monthly, remained a significant inflation driver, accounting for nearly 70% of the increase in all items excluding food and energy. Gasoline prices also surged by 2.8%, contributing to a 1.1% rise in the energy index. Despite these pressures, the Federal Reserve will likely delay rate cuts due to the uneven inflation landscape. The Real Rent Index increased by 0.1% in April, indicating a slower growth rate than the previous year. (NAHB)