👋👋 Good morning real estate watchers! Today, we are going to talk about how it’s officially a buyer’s market, which is like saying it’s officially beach season…in Antarctica. Sure, technically the conditions are better, but good luck finding anyone willing to strip down and dive in.

But first, here’s what we’ve been paying attention to this week…

1️⃣ More Homes, Fewer Bidders: Existing-home sales ticked up 1.5% in September as easing mortgage rates gave buyers more breathing room—but inventory rose even faster, hitting a five-year high. The result: plenty of homes on the shelf, but fewer shoppers reaching for their wallets. (HW)

2️⃣ Flat Now, Flicker Later: Zillow expects home values to end 2025 unchanged before picking up modestly next year, forecasting 1.9% growth by late 2026. For now, sales and rent growth remain subdued, suggesting a housing market more yawn than boom. (Zillow)

3️⃣ Haunted Housing Market: Fifteen percent of homebuying contracts fell through in September as jittery buyers walked away from deals, leaving sellers spooked. Florida and Texas led the ghosting parade, where nearly one in five contracts vanished faster than a down payment in a bidding war. (Redfin)

4️⃣ Rent Freeze Fever: Single-family rents rose 1.4% in August—the weakest growth in 15 years as new supply floods the market and tenants gain leverage. Dallas even saw rents dip, proving that in some cities, the rent really can go down. (CNBC)

5️⃣ Equity Eases Off: Nearly half of U.S. homeowners remain “equity-rich,” but that share slipped to 46.1% in Q3 as underwater mortgages ticked up slightly. After years of soaring values, homeowner equity is finally leveling off (less rocket ship, more cruise control). (ATTOM)

TOP STORY

GHOSTLY MARKET

On a quiet Saturday morning in Dallas, the open house was set like a stage play awaiting an audience. Balloons fluttered at the curb, a plate of cookies cooled by the door, and a realtor refreshed her Redfin app for the fifth time. Nobody came.

Across much of the United States, that scene has become the new normal. Mortgage rates have slipped to their lowest levels in nearly three years, sellers are becoming more flexible, and inventory is rising.

Economists call it a ‘buyer’s market,’ which is a bold label for a situation without actual buyers. That’s like calling a buffet ‘all you can eat’ after the restaurant burned down.

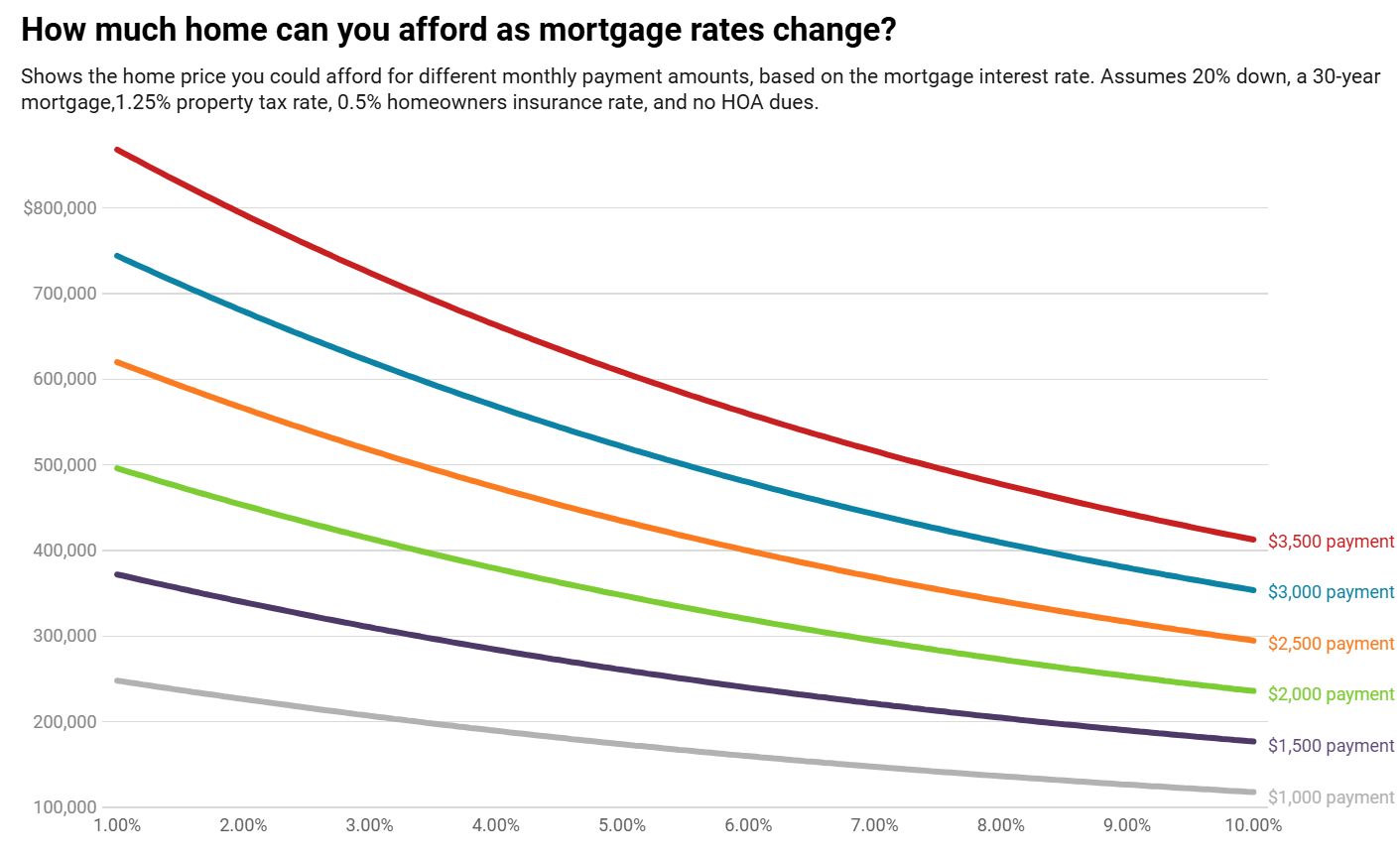

After two years of soaring mortgage rates, the long-awaited relief finally arrived. The average 30-year fixed mortgage has dropped to just over 6%, a sharp improvement from the nearly 7% peak of last year. For the typical homebuyer with a $3,000 monthly budget, that means an extra $25,000 to $30,000 of purchasing power compared to a year ago.

And yet, few seem interested. Pending home sales are slipping again after a brief summer rebound. Buyers who once complained of bidding wars now stare at listings that linger for weeks, but they’re not making offers.

Part of the problem is psychological. The same economic uncertainty helping drive mortgage rates lower (slower growth, political volatility, and talk of another mild recession) makes would-be buyers hesitant to commit to a 30-year loan. Even as affordability inches back, confidence hasn’t followed.

The Math Still Doesn’t Add Up

Despite the dip in borrowing costs, the overall price tag of homeownership remains historically steep. Home prices have barely budged from their pandemic highs, and the typical monthly mortgage payment (around $2,500 nationally) is still roughly double what it was in 2019.

Property taxes, insurance, and maintenance costs are eating away at what little relief falling rates provide. “It’s a buyer’s market only if you can actually afford to be a buyer,” one broker said wryly.

Sellers, meanwhile, are trying to adjust to the new mood. New listings are ticking higher, but many homeowners who locked in sub-3% mortgages during the boom are staying put. Those who do list are often dangling concessions: mortgage-rate buydowns, appliance credits, even months of prepaid HOA fees. Builders, sitting on fresh inventory, are cutting prices or offering steep incentives.

Bargains Hiding in Plain Sight

For those still in the game, the leverage has quietly shifted. All-cash buyers and those unfazed by higher rates are finding rare deals. In parts of Texas and Florida, buyers secure homes for tens of thousands under appraised value. Some new-construction communities are practically rolling out red carpets to get contracts signed.

But such buyers are increasingly the exception. The national housing market remains subdued, a paradoxical lull in which supply and demand are growing, but neither is fast enough to restore balance. The result is a standoff: sellers are ready to negotiate, but buyers are still circling the parking lot, not yet convinced the party’s worth entering.

The Hangover Phase

If the last housing cycle was defined by scarcity and competition, this one feels more like a hangover: slow, quiet, and heavy with caution. The shift toward a buyer’s market is real, but its benefits are confined to the few who can stomach today’s costs and tomorrow’s uncertainty.

It’s a peculiar moment in American housing: affordability improving on paper, sentiment collapsing in practice. The market whispers “go,” but consumers still hear “wait.” In short, it’s the rare kind of buyer’s market where the only thing missing is buyers.