💼 Blackstone Moves

briefcase | invest smarter

Will a property crisis in China impact U.S. real estate?

BLACKSTONE’S BIG MOVE

In the game of real estate chess, Blackstone just yelled 'King me!'—but in a posh accent, with a skyscraper instead of a checker piece.

Blackstone Inc., the world's largest commercial property owner and part-time deathstar, has made headlines with its strategic maneuvers. Amidst a climate of sluggish deal activity and valuation pressures, Blackstone's recent activities provide a lens through which to view the real estate market's current state and future trajectory.

A Real Estate Slowdown - The backdrop for Blackstone's recent activities is a real estate market experiencing a significant slowdown. MSCI data highlights a stark 51% fall in real estate deals compared to the previous year, underlining investor reticence amidst hopes for discounts reminiscent of 2009, which have yet to materialize.

That said, Blackstone still maintains almost $1 trillion in assets under management (AUM).

The market slowdown led to less than stellar returns for Blackstone in 2023, as noted on their most recent earnings call.

Despite economic uncertainties and market volatility, Blackstone still managed to generate a net profit increase from asset sales by 16%. However, the value of their opportunistic real estate portfolio saw a slight decline of 3.8%.

That said, Blackstone's strategic approach, focusing on markets with anticipated demand-supply constraints and the acumen to hold off on sales until valuations are deemed appropriate, reveals a more calculated approach to navigating the current market.

“We are heading to a better environment with the inflation and cost of capital environment moderating…Real estate values are bottoming…We would expect deal activity to pick up…We continue to see robust fundamentals…Our real estate will emerge from this cycle even stronger than before.”

Blackstone spent $31 billion in the last three months, which is 2.5x more than the previous quarter. They made three big deals recently: a $3.5 billion agreement to acquire Tricon Residential (see below), a partnership with Digital Realty to develop $7 billion worth of data centers, and a joint venture with the Federal Deposit Insurance Corporation to buy a 20% stake in a $17 billion first-mortgage portfolio from Signature Bank.

The Tricon Acquisition: A Strategic Expansion - While most of us decide between avocado toast or saving for a house, Blackstone's playing The Sims with actual cities. Blackstone's recent acquisition of Tricon Residential for $3.5 billion marks a bold expansion in the single-family home portfolio. Bought at a 30% premium over Tricon's last closing share price, this move is not just a transaction but a strategic positioning in high-growth markets.

A Vision of Market Recovery and Strategic Bets - Despite the downturn, Blackstone's leadership believes in the bottoming out valuations and foresees a short-term recovery. The firm's substantial investments, including major transactions in data centers and joint ventures with the FDIC, indicate a belief in future opportunities.

Blackstone's recent moves in the real estate market, from the strategic acquisition of Tricon Residential to its calculated approach amidst market slowdown, reflect a nuanced understanding of the market's current and future potential. While the market continues to face challenges, Blackstone's actions are a testament to the firm's confidence in its strategies and its readiness to capitalize on the opportunities that lie ahead.

HEADLINES

Just…The…Worst: In 2023, the US housing market experienced its toughest year in nearly three decades due to high mortgage rates nearing 8%, a severe housing shortage, and continuously rising home prices. The National Association of Realtors® reported a record median home price of $389,800, while the number of homes sold fell to the lowest level since 1995. Higher mortgage rates discouraged homeowners with low 2% or 3% mortgage rates from selling, further reducing the supply of homes. However, the situation is expected to improve with lower mortgage rates and an increase in housing inventory in the coming months. (NAR)

Bank of Mom and Dad: Most Americans under 30 lack financial independence from their parents. Only 16% of adults aged 18-24 and 44% of those aged 25-29 are off their parents' payroll. By their early 30s, 67% achieve full independence, but nearly one-third of adults aged 30-34 still receive parental help. The most common expenses parents assist with are household expenses, phone bills, and streaming subscriptions. The number of young adults living with their parents has increased to 57%, up from 53% in 1993. In the past year, 59% of parents financially assisted their adult children, with 64% stating it did little or no damage to their personal finances. Interestingly, 33% of adults aged 18-34 financially supported their parents in the past year. (Hustle)

Happy Builders: Builder confidence for newly-built single-family homes rose to 44 in January 2024, marking a seven-point increase and the second consecutive monthly rise, according to a National Association of Home Builders report. This increase is attributed to mortgage rates falling below 7% over the previous month. (Globe St)

BY THE NUMBERS

21%: A Zillow survey in Q4 2023 found that 21% of homeowners plan to sell their homes in the next three years, up from 15% last year. This willingness to sell is similar for homeowners with mortgage rates above or below 5%, indicating a change in the housing market for 2024. Monthly payments for new mortgages have decreased to $1,790, making home buying more affordable. However, the 20% down payment requirement is still challenging for first-time buyers. Inventory levels are improving but remain 36% below pre-pandemic levels. Despite these positive trends, nearly 30% of homes sell above their original list price due to competition. (Zillow)

5.5%: The latest Bloomberg Markets Live Pulse survey predicts that U.S. mortgage rates will decrease to 5.5% by the end of 2024, a drop of over a full percentage point from the current rate of 6.69%. This follows three years of consecutive increases and a 2023 slump in existing home sales to their lowest since 1995, with only 4.09 million homes sold. A study from John Burns Research and Consulting identified a 5.5% mortgage rate as a tipping point for home builders' success. However, high home prices remain a concern, particularly for first-time buyers, due to a collapse in affordability. (ConnectCRE)

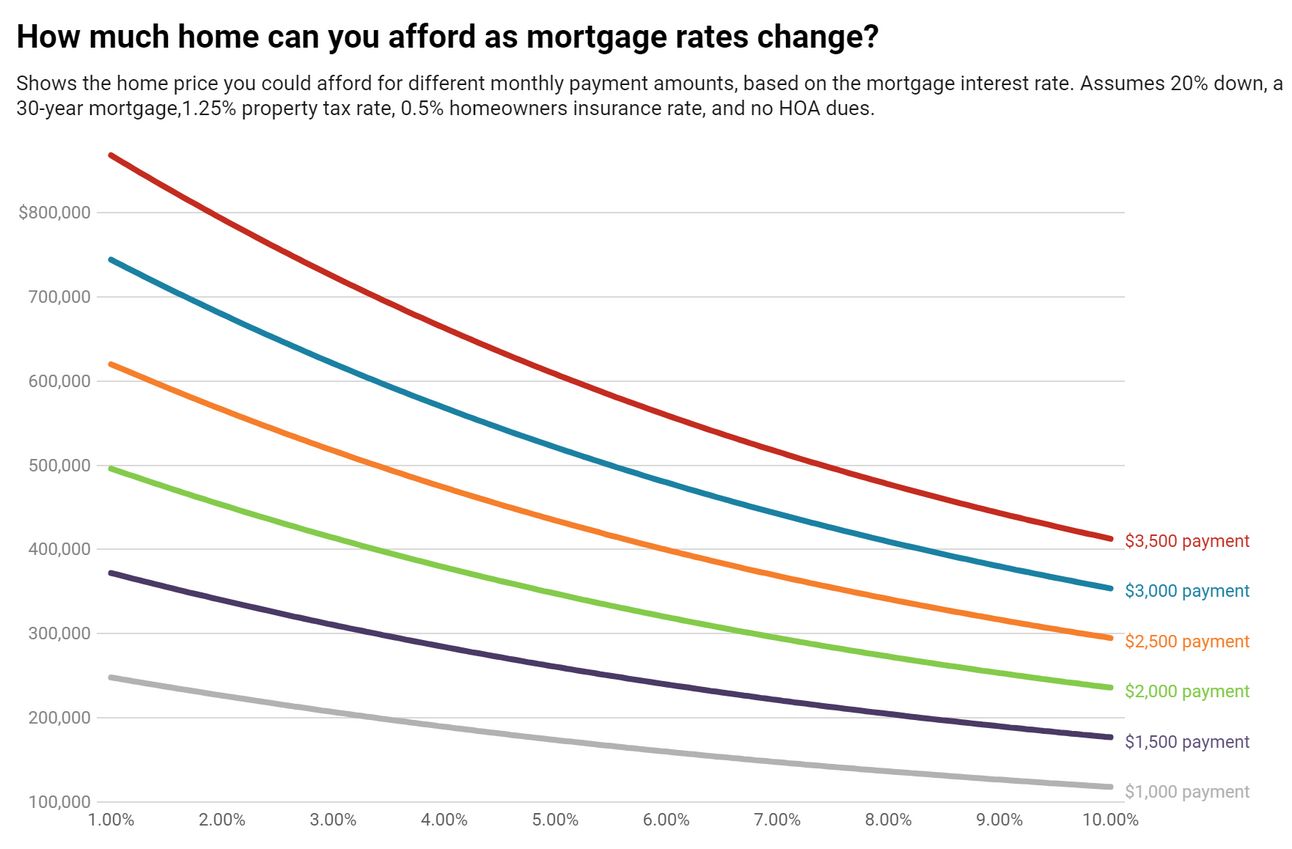

Chart: Mortgage rates have dropped to 6.7% from nearly 8% in October 2023, allowing buyers to afford more expensive homes. A homebuyer with a $3,000 monthly budget can now afford a $453,000 home, gaining nearly $40,000 in purchasing power since October 2023. The monthly mortgage payment on a typical U.S. home costing $363,000 is now $2,545, nearly $200 less than when rates were 7.8%. Despite rates being double the record-low 3% during the pandemic, buyers have accepted the 6% range. Bidding wars are increasing due to declining rates and low inventory. Redfin economists predict mortgage rates will end the year lower than they started, but the path will likely be bumpy. (Redfin)

LIGHTER SIDE

Meow…And WTF is Ziltorfin? CoStar Group CEO Andy Florance criticized Zillow, Realtor.com, and Redfin—which he called Ziltorfin—during his latest appearance at Inman Connect New York, accusing them of prioritizing profits over the needs of buyers and listing agents. He also defended the significant growth of Homes.com, a CoStar Group property, which saw its monthly unique visitors increase by 117% from 46.3 million in August to 100 million in September 2023. Competitors have accused CoStar of inflating these numbers through extensive paid advertising, but Florance insisted they use Google Analytics, a widely accepted standard. He also criticized the other platforms for making the listing agents' branding "subordinate to the portal's brand" and complicating the process of connecting consumers with agents. (Inman)