👋👋 Good morning real estate watchers! Today, we will discuss how experts are forecasting a 14% surge in home sales next year. That’s adorable. That’s like me predicting I’ll develop ‘visible abs’ next year. Technically possible, historically unsupported.

But first, here’s what we’ve been paying attention to this week…

1️⃣ $300B Rescue Remix: Bill Ackman is pitching a three-step overhaul of Fannie Mae and Freddie Mac that he says could hand taxpayers a $300 billion windfall. In a media blitz, he framed the plan as a long-overdue reset for America’s mortgage giants. (Fox)

2️⃣ Recession Red Flag: Fed governor Christopher Waller warned that “eye-popping” corporate layoffs and sinking consumer confidence are raising the odds of a U.S. recession. He signaled he’ll vote for a rate cut as the economy shows clear signs of slowing. (Telegraph)

3️⃣ The 59-Year-Old Starter Home: The median age of U.S. homebuyers has surged from 39 in 2010 to 59 today, reflecting how affordability pressures are locking younger Americans out of the market. Apollo’s Torsten Sløk highlights the shift as a stark sign of who can—and can’t—buy a home anymore. (Apollo)

4️⃣ Fed Fight Night: Fed minutes reveal officials were split over whether October’s rate cut was wise, exposing a deeper divide about whether another cut should happen in December. While some argue that slowing labor data warrants further easing, many believe inflation risks necessitate holding steady through 2025. (CNBC)

5️⃣ Jobs Report…Finally: After weeks of a shutdown-induced data blackout, the September jobs report arrived yesterday, showing a modest 50,000-job gain that still signals a weak labor market. The backward-looking release offers limited help for policymakers, but should provide investors and economists with at least some clarity after relying on private data for months. (CNBC)

TOP STORY

HOUSING PRAYERS ANSWERED (MAYBE)

Remember when buying a house didn't require the patience of a monk and the savings account of a tech CEO? Neither do most millennials. But the National Association of Realtors has a message for weary would-be homebuyers who've spent the past three years watching from the sidelines: 2026 might actually be your year.

NAR Chief Economist Lawrence Yun delivered his forecast at the association's Houston conference on Friday with the kind of optimism the housing market hasn't heard since mortgage rates had a "3" in front of them.

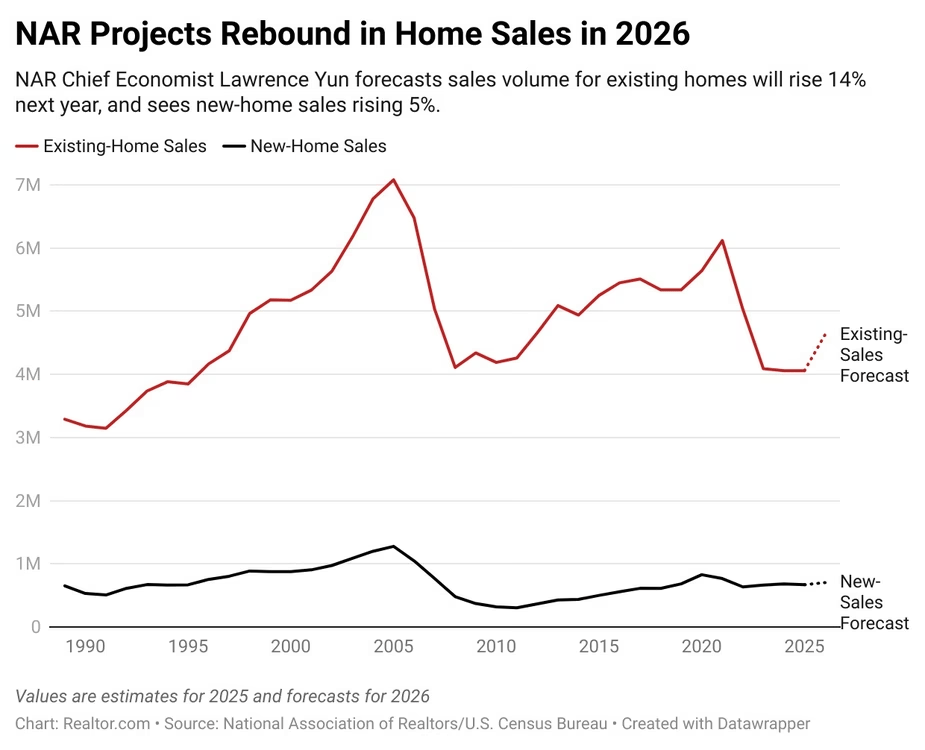

Either way, the bar for 2026 is so low that it has legally reclassified itself as a tripping hazard. Yun’s prediction? A 14% surge in existing home sales next year, accompanied by a 4% climb in home prices and new-home sales growth of 5%.

"Next year is really the year that we will see a measurable increase in sales," Yun said, adding with characteristic confidence that "home prices nationwide are in no danger of declining."

If this sounds familiar, it should. One year ago, Yun predicted existing home sales would rise 9% in 2025, with new-home sales jumping 11%. Instead, existing home sales flatlined, with 0% growth, and new-home sales actually fell by 2%. So naturally, everyone should rush to trust this year's forecast without question.

The Long, Cold Winter

To understand why 2026 might feel like spring after a brutal freeze, consider where we've been. The past three years produced the lowest volume of home sales since 1995, a period when "Friends" was must-see TV and people actually believed the internet was just a fad.

The culprit? Affordability became a four-letter word. The typical age of first-time homebuyers climbed to an all-time high of 40 this year, suggesting that the American Dream now requires an extra two decades of saving, several promotions, and possibly a small inheritance.

However, beneath the surface, buyer demand never truly disappeared; it simply went into a state of hibernation. Mortgage applications have consistently tracked above last year's levels, signaling what Yun calls "people's desire to enter the market has been consistently positive."

The problem? Those applications aren't translating into closings the way they used to. In the first half of 2025, only 55% of mortgage applications through banks were actually closed, a precipitous decline from 77% in 2021. It's the real estate equivalent of everyone swiping right but nobody going on actual dates.

A Modest Thaw

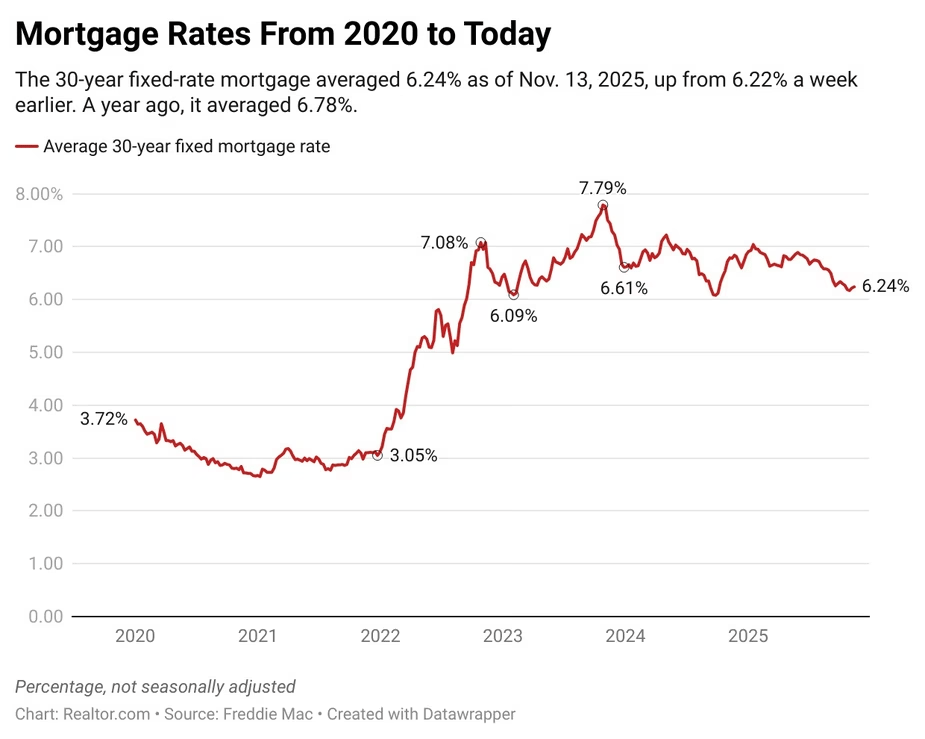

Yun's optimism for 2026 rests on two pillars: a solid job market expected to add 1.3 million positions, and a slight easing in mortgage rates. He forecasts rates will average around 6% next year, down from roughly 6.7% in 2025.

"As we go into next year, the mortgage rate will be a little bit better," Yun said. "It's not going to be a big decline, but it will be a modest decline that will improve affordability."

Translation: Don't expect the 3% rates of the pandemic era (those were about as sustainable as sourdough bread-making as a lifestyle). But even a modest decrease could unlock substantial buyer activity from those who've been waiting for any excuse to jump in.

The economist's forecast also predicts continued housing supply shortages, which will help prop up prices even as sales volumes increase. It's the classic real estate paradox: good news for sellers remains challenging news for buyers, although at least more transactions mean more people actually getting the keys.

Betting on the Bounce

Whether 2026 delivers on these rosy predictions remains to be seen. The housing market has proven remarkably resistant to forecasting, influenced by factors ranging from Federal Reserve policy to geopolitical events to the collective psychology of millions of Americans deciding whether this is finally the moment to make a move.

But for those who've spent recent years refreshing Zillow at midnight and touring homes that sold before the open house, Yun's forecast offers something in short supply: hope. And in a market where 40-year-olds are considered first-time buyers, even modest improvements sound downright revolutionary.

The housing market's message for 2026? Please, for the love of all things mortgage-related, be better than the last three years. The bar is low. Really, really low.